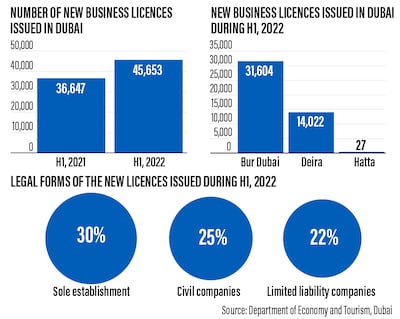

Dubai issued 45,653 new business licences in the first half of 2022, an annual jump of almost 25 per cent, reflecting strong business sentiment and robust growth in the post-Covid era, the Dubai Media Office said on Tuesday.

The growth comes on the back of the government's "strategic approaches and policy amendments" that have revitalised Dubai’s economy and stimulated a strong flow of local and foreign investment, it said.

The latest figures were released by the Business Registration and Licensing sector at the emirate’s Department of Economy and Tourism (DET).

DET’s director general

The figures highlight the “success of measures taken to ensure business continuity and provide the option of full ownership to foreign investors” that attracted foreign direct investment into vital sectors, said Helal Al Marri, DET’s director general.

“These measures have also enhanced Dubai’s growth-friendly and transparent investment environment, marked by exceptional ease of doing business and high levels of security and safety," he said.

Dubai's economy, which last year bounced back strongly from the coronavirus-induced slowdown, has carried that momentum into this year.

The emirate's economy grew 6.3 per cent a year in the first nine months of 2021, according to preliminary data from the Dubai Statistics Centre. Emirates NBD estimates that it grew about 5.5 per cent for the full year 2021 — an increase from its earlier forecast of 4 per cent.

Business activity in Dubai's non-oil private sector economy last month also improved at its quickest pace in three years, as new orders rose sharply despite inflationary pressures.

The headline seasonally adjusted S&P Global Dubai Purchasing Managers' Index rose to 56.1 in June from 55.7 in May, marking its highest reading since June 2019.

Among the new business licences issued in the first half of the year, nearly 55 per cent were professional while the remaining were commercial. Bur Dubai accounted for the largest share, with 31,604 new licences issued, followed by Deira (14,022) and Hatta (27).

Sole establishment companies topped the list with 30 per cent, followed by civil companies with 25 per cent and limited liability companies with 22 per cent.

The new data found that 261,958 business registration and licensing transactions were completed in the first half of the year, a yearly growth of 33 per cent.

The number of renewal transactions during the period jumped to 92,948, a growth of 22 per cent compared with the first half of last year.

A total of 14,654 instant licences were issued "in minutes" through the Invest in Dubai digital business set-up platform, the media office said.

“The new data reflects Dubai’s dynamic entrepreneurial landscape, its globally competitive offerings for businesses and the confidence that local, regional and global investors have in its growth prospects,” Mr Al Marri said.

The DET, which was formed after Dubai's departments of economy and tourism were merged last November, focuses on enhancing ease of doing business in the emirate and expanding investment and growth.

It also promotes collaboration between the government and private sectors to advance the emirate’s economic development.