There is an urgent need for cross-border collaboration and co-operation to address the technological, legal, regulatory and supervisory challenges associated with the adoption of cryptocurrencies, according to the International Monetary Fund.

“Setting up a comprehensive, consistent and co-ordinated regulatory approach to crypto is a daunting task. But if we start now, we can achieve the policy goal of maintaining financial stability while benefiting from the benefits that the underlying technological innovations bring,” senior officials at the Washington-based lender said in a note on Thursday.

The fund's commentary is by Tobias Adrian, director of the IMF’s monetary and capital markets department, Dong He, the deputy director of the monetary and capital markets department, and Aditya Narain, a deputy director in the IMF’s monetary and capital markets department.

The industry’s cross-sector and cross-border remit limits the effectiveness of national approaches, the IMF said. Many cryptocurrency service providers operate across borders, making the task for supervision and enforcement more difficult, the lender added.

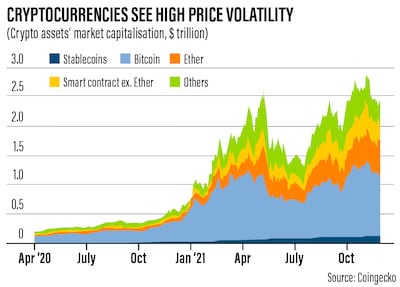

Interest in cryptocurrencies and blockchain is surging as investors and people flock to digital assets and online payments gain pace. A growing number of institutional investors and wealth managers plan to increase their exposure to cryptocurrency assets between now and 2023, according to a survey by Nickel Digital Asset Management, based in London.

“Determining valuation is not the only challenge in the cryptocurrency ecosystem: identification, monitoring and management of risks defy regulators and firms,” the IMF officials said in their commentary.

Some of these risks include operational and financial integrity risks from cryptocurrency asset exchanges and wallets, investor protection and inadequate reserves and inaccurate disclosure for some stablecoins, they said.

The advent of cryptocurrency can accelerate “cryptoisation” in emerging markets and developing economies – when so called digital assets replace domestic currency and circumvent exchange restrictions and capital account management measures, they said.

The risks underscore the need for "comprehensive international standards that more fully address risks to the financial system from crypto assets, their associated ecosystem and their related transactions, while allowing for an enabling environment for useful crypto asset products and applications”, the IMF officials said.

The organisation recommended the Financial Stability Board (FSB), which reports to the Group of 20 nations, to develop a global framework comprising standards for regulation of cryptocurrency assets with an aim to provide a comprehensive and co-ordinated approach to managing risks to financial stability and market conduct that can be consistently applied across jurisdictions.

The fund said it will work closely with the FSB and other members of the international regulatory community to develop an effective regulatory approach to cryptocurrency assets.

“The global regulatory framework should provide a level playing field along the activity and risk spectrum,” IMF officials said.

The framework should stipulate that crypto-asset service providers that deliver critical functions be licenced or authorised. Licencing and authorisation criteria should be clearly articulated, the responsible authorities clearly designated and co-ordination mechanisms among them well defined, the IMF recommended.

Authorities should also provide clear requirements to regulated financial institutions concerning their exposure to and engagement with cryptocurrency, the lender said.

The framework should also mandate that requirements be tailored to the main use cases of cryptocurrency assets and stablecoins, according to the lender.

“For example, services and products for investments should have requirements similar to those of securities brokers and dealers, overseen by the securities regulator. Regardless of the initial authority for approving crypto services and products, all overseers – from central banks to securities and banking regulators – need to coordinate to address the various risks arising from different and changing uses,” IMF officials said.