India’s financial crisis has hit ordinary people hard. Schoolteachers and electrical engineers have seen their pension savings get stuck in bonds of defaulted institutions. More than a million depositors of a cooperative bank can’t access their cash. Homeowners have spent billions of dollars on apartments that will never be finished.

Yet for workers in rich nations, the blow-up in India’s shadow-banking and real-estate industries is an opportunity. Will they profit from it or get burnt like their Indian counterparts? The answer will depend on the skill of money managers — and the Indian government’s eagerness to douse the fire in the finance industry by enlisting foreigners and giving them a fair shake.

Ever since troubles first surfaced in September last year, AustralianSuper, Ontario Teachers’ Pension Plan, California State Teachers’ Retirement System, and the Commonwealth of Pennsylvania Public School Employees’ Retirement System have committed between $100 million (Dh367m) and $400m million each to private equity funds investing in India. Of the total PE funds raised from limited partners, the biggest chunk of $1.2bn is for finding opportunities in debt. Another $900m is for real estate. Infrastructure, where funding for everything from roads to power projects has dried up, has received another $500m in commitments.

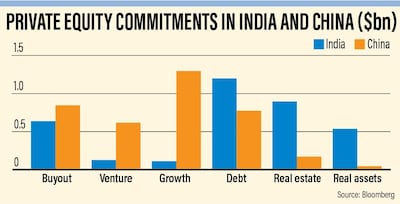

The $2.6bn set aside for Indian debt, property and infrastructure may appear insignificant when compared with, say, Masayoshi Son’s $100bn Vision Fund. Nonetheless, it’s almost triple what limited partners have earmarked for debt and hard assets in China, according to data compiled by Bloomberg. While larger sums are still being allocated to China-oriented funds focused on buyouts, new ventures and growth opportunities, none of those strategies have seen much interest when it comes to India. Distress is all that excites PE investors right now.

India’s stressed corporate debt is a $260bn problem, according to Fitch Ratings’ calculations. Sceptics would be right to wonder whether $2.6 billion of foreign money will make any dent. The important thing is that these commitments are pure equity, the one thing that’s in woefully short supply in the domestic economy. Every dollar is welcome — especially if it comes with the possibility of a few more in the future.

Take the recent agreements by AustralianSuper and Ontario Teachers. Australia’s largest superannuation fund and the manager of teachers’ savings in Canada’s most populous province are investing $250 million each in the master fund of National Investment and Infrastructure Fund. The Indian government owns 49 per cent of NIIF, but has only two seats on the seven-member board. The Mumbai-based institution’s capacity for independent, commercially-minded action makes it best suited to drive the cleanup, especially in its core area of infrastructure. That’s why, in addition to what they’ve already signed up for, both AustralianSuper and Ontario Teachers have secured co-investment rights of $750m apiece alongside NIIF.

That’s firepower of $2bn from just two investors. As long as managers like NIIF don’t overpay, and the earning potential of the assets they buy isn’t destroyed by India’s typical problems of bureaucratic zeal and judicial overreach, foreigners’ returns can be amplified with safe levels of debt.

The asset reconstruction business in India has grown to $15bn from under $2bn six years ago. Of late, though, the pace at which specialist firms acquire troubled loans from banks has slowed to a crawl. That’s because earlier it was common for a lender selling stressed assets to provide the financing for most of the purchase. However, the central bank has made it progressively difficult for lenders to engage in this sleight of hand. Now the deals are fewer, but more real. Outside investors need to pony up more of their own cash to complete transactions. Foreign capital has therefore become that much more crucial.

Will India keep its end of the bargain? Foreign investors would be reassured if the thinking around distress resolution was less muddled. For instance, Finance Minister Nirmala Sitharaman on Wednesday announced an enlarged $3.5bn fund, with money from the government as well as domestic institutions such as Life Insurance Corporation to give new loans to stalled property projects. A half-built apartment complex that has run up years of accrued interest on existing debt can't suddenly earn enough to pay new and old creditors. A much better use of domestic long-term money would be for it join private-equity investors in buying out all the debt from banks and mutual funds at say, 40 cents to the dollar, sell apartments by slashing prices and hope to recover 60 cents in two years for a decent 25 per cent annual return.

That isn’t all. State workers’ pension plans in Virginia, South Carolina and New York have invested in funds started by the likes of Edelweiss Financial Services, Kotak Investment Advisors, Hong Kong-based SSG Capital Management, Canada’s Brookfield Asset Management and several others. More would come if it weren’t for the country’s three-year-old insolvency law, which is fast becoming a burial ground for capital with four times as many firms getting liquidated as have been restructured.

Long, drawn-out legal battles, weird judicial orders and authorities swooping down to seize assets are all very real problems. For workers of the world to unite and get a decent recovery rate on savings that workers in India have lost, New Delhi has to offer a fair, time-bound, rules-based corporate insolvency process. That’s the least it can do.

Bloomberg