Hometown London stars Dua Lipa and Stormzy were both double winners Wednesday at the U.K. music industry’s Brit Awards, where many guests wore white roses to symbolise the fight against sexual harassment and assault.

Stormzy, who has helped propel the grime genre of rap into the commercial mainstream, was named best male British solo artist, and also won album of the year, for his debut Gang Signs and Prayer.

Taking the stage, he thanked God, his mother, his family, his team and south London, where he grew up.

READ MORE: The best-dressed at the Brit Awards - in pictures

Stormzy said the album was “the hardest thing, I’ve never worked on something like this in my life.”

“I’ve never given my entire being, I didn’t have anything left after ... we made something I feel that is undeniable, that I can stand by today,” he said.

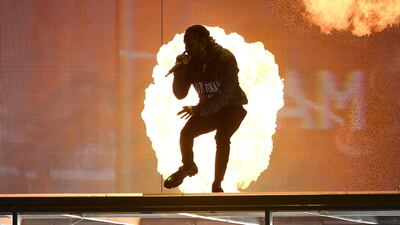

Stormzy also energised a show that bordered on bland. In an electric closing performance, he put Britain’s prime minister on the spot, singing “Theresa May, where’s the money for Grenfell” in reference to last year’s deadly London tower block blaze.

Lipa, whose self-titled debut was one of 2017’s breakout albums, was named British female solo artist and British breakthrough artist.

She dedicated her solo artist trophy to all the female musicians who “have allowed us to dream this big.”

“Here’s to more women on these stages, more women winning awards and more women taking over the world,” said Lipa, who topped UK charts with her catchy breakup anthem No Rules.

Following up on gestures at the Golden Globes, Grammys and British film awards, guests at Britain’s biggest music awards show were given flowers or white rose pins to wear in solidarity with the Time’s Up movement.

Calls for change have swept through the entertainment industry since women began coming forward to accuse Hollywood producer Harvey Weinstein last year.

The white rose symbol made an appearance at the Grammys last month. At the Globes and British Academy Film Awards women wore black to oppose sexual misconduct and bullying.

Performers at the show at London’s O2 Arena included Justin Timberlake, Rita Ora, Sam Smith, Foo Fighters and Kendrick Lemar.

International winners included Foo Fighters in the group category, female solo artist Lorde and male solo artist Kendrick Lamar.

Soulful singer Rag’n’Bone Man took the trophy for best British single for Human.

Ubiquitous singer-songwriter Ed Sheeran won the global success award, which goes to the year’s best-selling British artist. His album Divide has sold more than 12 million copies around the world.

In what felt like a symbolic handover between generations, Sheeran’s prize was introduced by a video message from Elton John. He was given his trophy by Rolling Stone Ronnie Wood, who called Sheeran “a lovely young guy.”

Ariana Grande had been due to perform, but was forced to pull out because of illness, organisers said. She had been due to make a surprise appearance in tribute to 22 people killed when a bomber blew himself up at a Grande concert in Manchester in May.

Manchester-born Liam Gallagher stepped in instead, performing the Oasis classic Live Forever.

Once a slightly ramshackle and unpredictable event, the Brits has become a slick showcase for UK and international talent.

This year’s show did feature some pointed moments. As well as Stormzy’s Grenfell shout-out, former Blur frontman Damon Albarn alluded to Brexit as he accepted the best British group prize with cartoon band Gorillaz.

In an apparent reference to Britain’s impending departure from the European Union, he urged Britons not to let the country become isolated.

“Considering our size we do incredible things in music, we’ve got a real spirit and a real soul, and don’t let politics get in the way of all that, alright?” Albarn said.

Most winners at the Brits are chosen by a ballot of music-industry members, with several selected by public vote, including video of the year, decided by public ballot during the show. For years that prize was invariably won by One Direction; this year it went to a member of that band, Harry Styles.