Our modern times seem perfectly suited for the short film. The format should benefit from advances in mobile technology, increased leisure time and diminished attention spans. Yet try to name one of your favourite shorts from the past year. An Oscar nominee? An Oscar winner? From any year? How about five short films ever?

All I could come up with off the top of my head were the Lumière brothers' train short (one of the first films ever made), Martin Scorsese's The Big Shave and the little animated stories they show before Pixar movies – and I consider myself a film buff.

“Every short film has a big problem,” admits Saleh Karama, the director of the Emirates Film Competition, which is showing 53 non-features as part of the Abu Dhabi Film Festival this year. “They can play at festivals and on TV sometimes, but there isn’t a lot of space for shorts. That makes it a little difficult for marketing.”

For this feature about marketing short films, I contacted six filmmakers whose works are screening as part of ADFF. Two replied. “Sorry for the tardy response,” one wrote. “Unfortunately I know nothing about, nor have I done anything towards marketing my film.”

To borrow a line from Cool Hand Luke, what we have here is failure to communicate. Fortunately for aspiring filmmakers in the UAE, the organisers of this year's ADFF had the foresight to invite short-film programmers from some of the world's most prestigious festivals to participate in a panel entitled The Long and Short of It: I've Made a Short Film. Now What?

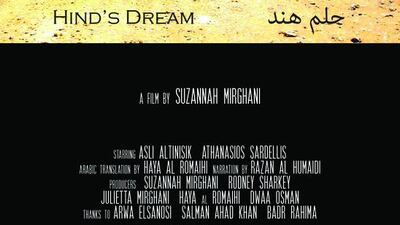

Here's some of their practical advice, along with the case study of Hind's Dream, a short film by Suzannah Mirghani that screened as part of the EFC.

Get ahead in advertising

Mirghani's short tells the story of a Bedouin girl who dreams about the future while waiting for her husband to return from a hunting trip. The communication-and-media-studies student from Doha made Hind's Dream without funding from any government agencies. As an independent filmmaker, she doesn't have a lot of money to publicise her work. "A filmmaker can always do more to market a film," she says.

To create buzz for her film, Mirghani created a film poster and used the cheapest modern-day form of advertising. “Social media is now, without question, a necessary step a filmmaker has to take to circulate information about their film,” she says.

Facebook, Twitter, etc, are free, but if filmmakers don’t do their homework, they will get what they pay for online. Scriptmag.com notes, for example, that even if you can get people to "like" your Facebook page, the algorithm blocks most smaller companies' posts on people's Facebook feeds. Another pitfall, Mirghani notes, is the vast volume of competition for people’s attention. “Rather than adding to the noise that is out there, people should be selective in how, where and when they [post]. Just because it’s free to upload news of a film, doesn’t mean it won’t be perceived as terribly annoying.”

Find your festival

All the marketing in the world won’t pay off unless a film is actually seen by an audience. “Film festivals really give the best visibility to short filmmakers,” says Ben Thompson, the short film programmer at the Tribeca Film Festival and one of the panelists at The Long and Short of It.

Sound advice, until you realise that there are now close to 3,000 festivals worldwide, everything from the Human Rights Human Dignity festival in (cough) Myanmar to the Puchon International Fantastic Festival in South Korea. Instead of sending out screeners willy-nilly, Thompson recommends filmmakers put a little thought into the festival that best suits their film. “I think it helps to have a specific festival or set of festivals in mind from the beginning [of the filmmaking process],” he says. “It helps give filmmakers a deadline to focus on and gives them a better sense of their audience.”

The EFC helps local filmmakers in finding festivals that fit. In addition to ADFF, Karama helps arrange screenings at the Goethe-Institut and Abu Dhabi College.

Case study: Mirghani realises that her film appeals mostly to Gulf audiences. After Abu Dhabi, Hind's Dream is scheduled to play at the Ajyal Youth Film Festival in Doha from December 1 to 6. She also hopes to screen it in Dubai.

Group it up

Although Mirghani represents the maverick independent filmmaker going it alone, she and other filmmakers in her situation should think about banding together. “Hollywood has a machine to make and distribute films,” says Maike Mia Höehne, the short-film programmer for the Berlinale for the past seven years. “Independent filmmakers have to make the machine on their own. As a single person, it’s difficult. But if you make groups, they are bigger, and people, such as journalists, like groups.”

Höehne notes the success of collectives in Romania and Argentina that have lead to internationally acclaimed feature-length work (4 Months, 3 Weeks and 2 Days from Romania won the Palme d'Or in 2007; Argentina's The Secret in Their Eyes won the Oscar for the Best Foreign Language Film in 2009) and suggests this approach might work well in this region.

“We, as Europeans, always look to the East, because we want to see different films,” she says. “I’m a big fan of groups. They help filmmakers relate and ask what they want as a group. It’s not easy, but it is interesting to see the world from the point of view of this part of the world. Filmmakers should be concerned with how to not be the same as New York.”

Case study: While she isn't part of an official film collective, Mirghani enlisted the help of students and staff from Georgetown University, Doha.

Shoot early, shoot often

After further research, I can now name many successful short films. Bottle Rocket by Wes Anderson, for example, was a short film before it was a feature. Sling Blade was originally a short called Some Folks Call It a Sling Blade. And Mike Judge did a shorter, animated version of one of the characters in Office Space called Milton.

ADFF, too, has screened some impressive short films. Before Benh Zeitlin directed Beasts of the Southern Wild, he made Glory at Sea, which played here in 2009. Similarly, the Kurdish director Hisham Zaman screened his short film Bawke at ADFF in 2007 before returning last year with his acclaimed Before Snowfall.

Yet the last piece of advice on making and marketing short films is to forget all about success. “Don’t get crazy with your first film,” Höehne says. “Concentrate on your film, and if it’s good, it will make its way. If it doesn’t, make your next film.”

Case study: Hind's Dream is Mirghani's second film. Her first film, Hammour, was made in conjunction with the Doha Film Institute.

weekend@thenational.ae