When the row over Sanjay Leela Bhansali's Padmaavat erupted last spring, no one could have imagined that we would still be talking about it nearly a year later, with the nation of India on tenterhooks ahead of today's release date and protest groups in no mood to compromise despite a series of concessions.

The film’s title has been changed; several controversial scenes, including a dance sequence, have been tweaked; and it now carries a disclaimer that it’s not a historical account but is inspired by a poetic tribute to an imaginary queen by the famous 16th century Sufi poet Malik Muhammad Jayasi.

While audiences abroad will be able to watch it this weekend (today marks its worldwide release, including in the UAE), millions of movie buffs in India can't. At best, only a limited release (in southern and eastern India) is likely. With the possible exception of Delhi, Padmaavat is unlikely to be released in most of the northern and western Indian states, ruled by prime minister Narendra Modi's Bharatiya Janata Party.

There’s no official ban on the film, since the Supreme Court struck down orders issued by four BJP-governed states – Gujarat, Rajasthan, Madhya Pradesh and Jharkhand. But cinema owners are not willing to take risks in the face of protests and threats of violence from right-wing Hindu groups. They claim that the film distorts history and presents Rani Padmavati – a revered 14th century Rajput queen famed for beauty and valour – in a poor light and hurts Rajput sentiments.

Over the past week several multiplexes across India have been attacked by armed mobs and on Wednesday scores of protesters were arrested for acts of vandalism. Other incidents, mostly in Modi’s native Gujarat, have included blocking highways and stoning vehicles, even forcing police to open fire.

Lokendra Singh Kalvi, founder of Shree Rajput Karni Sena, a Rajput caste group, said: "If the movie releases and there is violence, S Bhansali will be responsible. He created this spectacle." Raj Shekhawat, the group's Gujarat president, said: "We will not let theatres screen the film, and will burn them down if needed. While we respect the Supreme Court, we are very unhappy with the decision."

Exhibitors in two other BJP territories – Haryana and Uttar Pradesh – are reluctant to act. "All it takes to cause mayhem is for someone to throw a stone and we don't want to risk that," said Khem Chand, in Ghaziabad, Uttar Pradesh.

______________

Read more:

Padmaavat released across India amid high security

5 Bollywood films that faced controversy before release

Pad Man release date moved back; stars of Padmaavat thank Akshay Kumar

______________

The Central Cinema Circuit Association said its members would not release Padmaavat. Manubhai Patel, president of the Gujarat Multiplex Owners Association, said: "We will not screen the film till we get a directive from the state government. We are also demanding adequate security as we cannot put the public, our staff and our property at stake."

Critics have alleged "collusion" between the Rajput Karni Sena and the BJP. There's also talk of an "unofficial ban" through a "janata [public] curfew", to prevent people from seeing the film. Kalvi has threatened to mobilise "thousands" of women for "jauhar" (self-immolation) to recreate the "valour" of Padmavati, who is said to have immolated herself to escape being captured by Muslim ruler Allauddin Khilji.

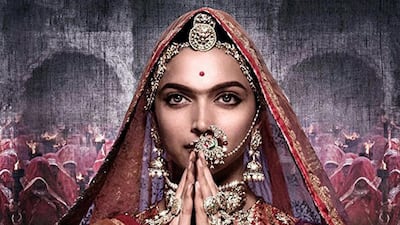

Padmaavat is Bhansali's most expensive and ambitious film and stars with Deepika Padukone, but its fate now hangs in the balance amid a culture of intolerance.