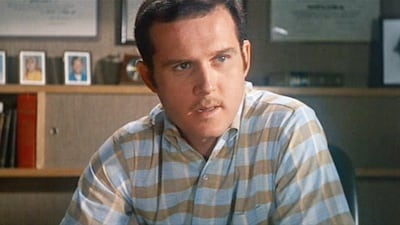

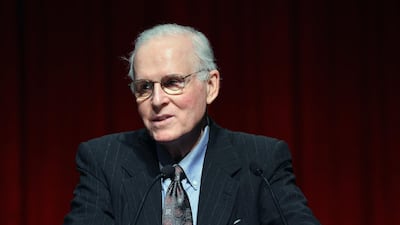

Charles Grodin, the droll, offbeat actor and writer who scored as a caddish newly-wed in 1972's The Heartbreak Kid and later had roles from Robert De Niro's counterpart in the comic thriller Midnight Run to the bedevilled father in the Beethoven comedies, has died. He was 86.

Grodin died Tuesday in Wilton, Connecticut, from bone marrow cancer, his son Nicholas Grodin said.

An illustrious career

Known for his deadpan style and everyday looks, Grodin also appeared in Dave, The Woman in Red, Rosemary's Baby and Heaven Can Wait. On Broadway, he starred with Ellen Burstyn in the long-running 1970s comedy Same Time, Next Year, and he found many other outlets for his talents.

With bone-dry understatement, Grodin could steal entire scenes with just a look. His commitment, whether acting across De Niro or Miss Piggy, was unsurpassed. Among his many late-night appearances, he once brought a lawyer with him to threaten David Letterman for defamation. (The lawyer instead took a shine to Letterman.)

Hosting Saturday Night Live, he pretended to not understand live television, ruining all the sketches. Steve Martin, who co-starred with Grodin in 1984's The Lonely Guy, remembered him as "one of the funniest people I ever met".

In the 1990s, Grodin made his mark as a liberal commentator on radio and TV. He also wrote plays and television scripts, winning an Emmy for his work on a 1997 Paul Simon special, and wrote several books humorously ruminating on his ups and downs in show business.

Actors, he wrote, should "think not so much about getting ahead as becoming as good as you can be, so you're ready when you do get an opportunity. I did that, so I didn't suffer from the frustration of all the rejections. They just gave me more time." He spelled out that advice in his first book, It Would Be So Nice If You Weren't Here, published in 1989.

From 'Rosemary's Baby' to 'Beethoven'

Grodin became a star in the 1970s, but might have broken through years earlier: he auditioned for the title role in Mike Nichols's 1967 classic The Graduate, but the part went instead to Dustin Hoffman.

Grodin did have a small role in Rosemary's Baby and was part of the large cast of Nichols' adaptation of Catch-22 before he gained popularity in the 1972 Elaine May comedy The Heartbreak Kid.

He starred as a Jewish newly-wed who abandons his comically neurotic bride to pursue a beautiful, wealthy blonde played by Cybill Shepherd. The movie was a hit and Grodin received high praise. He commented: “After seeing the movie, a lot of people would approach me with the idea of punching me in the nose.”

"I thought the character in The Heartbreak Kid was a despicable guy, but I play it with full sincerity," Grodin told the AV Club in 2009. "My job isn't to judge it. If it wasn't for Elaine May, I probably would never have had that movie career."

In the next few years, Grodin played a greedy showman who brings the big ape to New York in a lavish 1976 film remake of King Kong. He was Warren Beatty's devious lawyer in Heaven Can Wait, and Gene Wilder's friend in The Woman in Red. (Less successfully, he appeared in May's 1987 adventure comedy Ishtar, a notorious flop). His turn in 1981's The Great Muppet Caper was typically dedicated as a thief wooing Miss Piggy.

In 1988's Midnight Run, Grodin was a bail-jumping accountant who took millions from a mobster and De Niro was the bounty hunter trying to bring him cross-country to Los Angeles. They're being chased by police, another bounty hunter and the mob, and because Grodin is afraid of flying, they are forced to go by car, bus, even boxcar.

Grodin and De Niro improvised in many scenes in the film, revered as among the greatest buddy comedies.

“I moved a little more toward drama and he moved a little toward comedy,” Grodin said at the time. “And we met on a very good ground.”

Beethoven brought him success in the family-animal comedy genre in 1992. Asked why he took up such a role, he told The Associated Press he was happy to get the work.

“I’m not that much in demand,” Grodin replied. “It’s not like I have this stack of wonderful offers. I’m just delighted they wanted me.”

A television and on-stage regular

Amid his film gigs, Grodin became a familiar face on late-night TV, perfecting a character who would confront Johnny Carson or others with a fake aggressiveness that made audiences cringe and laugh at the same time.

"It's all a joke," he told The Los Angeles Times in 1995. "It's just a thing. It was a choice to do that."

His biggest stage success, by far, was Same Time, Next Year, which opened on Broadway in 1975 and ran for nearly three-and-a-half years. He and Burstyn were two people who – though each happily married – meet in the same hotel once a year for an extramarital fling.

Beyond the humour, the play won praise for deftly tracing the changes in their lives, and in society, from the 1950s to the 1970s. Critic Clive Barnes called Grodin's character "a monument to male insecurity, gorgeously inept".

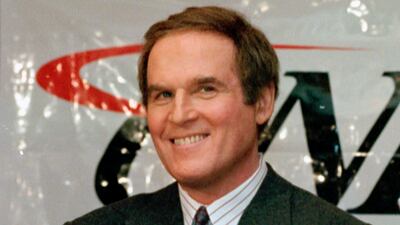

After 1994's My Summer Story, Grodin largely abandoned acting. From 1995 to 1998, he hosted a talk show on CNBC cable network. He moved to MSNBC and then to CBS' 60 Minutes II.

In his 2002 book, I Like It Better When You're Funny, he said too many TV programmers' believe that viewers are best served "if we hear only from lifelong journalists". He argued that "people outside of Washington and in professions other than journalism" also deserved a soapbox.

He returned to the big screen in 2006 as Zach Braff's know-it-all father-in-law in The Ex. More recent credits include the films An Imperfect Murder and The Comedian and the TV series Louie.

Who was Charles Grodin?

Grodin was born Charles Grodinsky in Pittsburgh in 1935, son of a wholesale dry goods seller who died when Charles was 18. He played basketball and later described himself as “a rough kid, always getting kicked out of class”.

He studied at the University of Miami and the Pittsburgh Playhouse, worked in summer theatre and then struggled in New York, working nights as a taxi driver, postal clerk and watchman while studying acting during the day.

In 1962 Grodin made his Broadway debut and received good notices in Tchin-Tchin, a three-character play starring Anthony Quinn. He followed with The Absence of a Cello in 1964.

He co-wrote and directed a short-lived 1966 off-Broadway show called Hooray! It's a Glorious Day ... and all that. That same year, he made his movie debut in a low-budget flop called Sex and the College Girl.

In 1969, Grodin demonstrated his early interest in politics by helping write and direct Songs of America, a TV special starring Simon and Garfunkel that incorporated civil rights and anti-war messages. But the original sponsor pulled out and Simon later called the little-noticed effort "a tragedy".

Simon returned with a special in 1977 that spoofed show business and featured Grodin as the show’s bumbling producer. Grodin and his co-writers won Emmys.

Grodin and his first wife, Julia Ferguson, had a daughter, comedian Marion Grodin. The marriage ended in divorce. He and his second wife, Elissa Durwood, had a son, Nicholas.