With J.D. Salinger's centennial coming next year, the big news so far is that his publisher is planning to celebrate it.

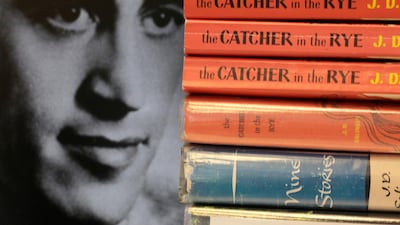

Little, Brown and Company announced on Tuesday that new editions of The Catcher in the Rye and his three other works of fiction — Franny and Zooey, Nine Stories and Raise High the Roof Beam, Carpenters and Seymour: An Introduction — would be released in November. Nationwide events will be announced later this year, Little, Brown said.

The anniversary editions will include paperbacks with new covers and a bound set of unjacketed hardcovers. Little, Brown did not mention any releases of books Salinger reportedly left unpublished at the time of his death in 2010.

"We're thrilled to be publishing these beautiful new editions to coincide with Salinger's centennial year," Little, Brown publisher Reagan Arthur said in a statement. "J.D. Salinger had a unique ability to connect with readers through a character's voice — readers have often said, upon encountering his fiction for the first time, that they felt as if it had been written just for them. We hope these reissued editions will help a new generation of readers discover the immense pleasures of reading his work."

According to Little, Brown, the New York Public Library will have an exhibition in October 2019, featuring "manuscripts, letters, books and artefacts from Salinger's archive."

Salinger readers may regret that no new work has been announced, but it's a surprise that his publisher will do anything.

In his lifetime, Salinger gave few interviews and had no use for anniversaries or reissues or anything that might attract publicity, such as allowing e-books or audio editions. Little had changed since his death.

"My father hated birthdays, holidays, and pretty much any planned or culturally mandated celebrations, and he'd certainly hate this centennial — but he loved writing and he loved his readers, and I hope his readers will be glad for an excuse to remember him in this way," Matt Salinger, the author's son, said in a statement.

"I would also love for more people to read his last two books, Franny and Zooey and Raise High the Roof Beam, Carpenters and Seymour: An Introduction, for I hear his voice the clearest in these," Matt Salinger said. "He once said that he wrote his first two books with at least part of an eye on selling them, whereas he wrote the last two because he longed to READ them. I hope that over the course of the year more people will join him in loving to read these books, and will come to know his work even better."

________________________

Read more:

Reham Khan's tell-all memoir tells one side of the Imran Khan story

Mysterious author Elena Ferrante supervised screen version of 'My Brilliant Friend'

Ruqaya Izzidien on challenging the ‘rose-tinted view of Empire’ in her debut novel

________________________