The Abu Dhabi International Book Fair was officially unveiled yesterday at the Al Maqta Hotel.

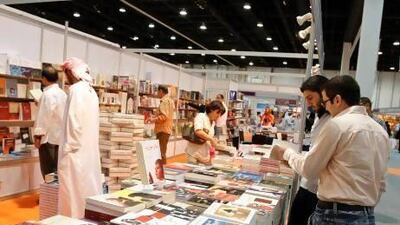

The fair, now in 23rd year, returns to the Abu Dhabi National Exhibition Centre from April 24 to 29 and features more than 1,000 exhibitors from 50 countries.

Organised by the Abu Dhabi Tourism and Culture Authority (TCA Abu Dhabi), this year’s festival is set to be the biggest, with a 15 per cent increase in exhibition space including a new fifth hall.

“The Abu Dhabi International Book Fair is recognised as the region’s most professional book fair and one of the world’s fastest-growing publishing event,” said Mubarak Al Muhairi, TCA Abu Dhabi director general.

“We have enhanced the fair’s cultural and professional programmes to include new panel discussions and to highlight different cultural elements this year.”

With the United Kingdom being The Country of Focus last year, the book fair now moves closer to home with the GCC being at the front and the heart of the event’s cultural festivities.

Each night a musical act from across the GCC will perform, showcasing their nation’s respective culture and traditions.

“These will be great events,” said Mohammed Al Shehi, the fair’s director of publishing.

“With the focus being on the GCC, it is an opportunity to learn about the cultural, writing and publishing world of the region.”

Young readers are another demographic the fair is targeting this year. Courtesy of the Rooftop Rhythms Open Mic night, amateur poets can present verses throughout the festival, while the Illustrators and Creativity corners will hold workshops discussing animation, the environment and traffic awareness.

Industry workshops will also highlight the growth of children’s publishing in the region. “Given our growing emphasis on young people, our focus will also be on content produced for children and young adults,” Mr Al Shehi said.

For more details visit www.adbookfair.com