Demand for artworks from across the Middle East is on the up.

Christie’s announced a live auction and online sale of regional modern and contemporary art brought in more than $3 million last week, with several sales far exceeding initial estimates.

The live auction was held in London last Wednesday; its online counterpart ran for three weeks and closed the day after. The top lot of the sale was Broken Land by Iranian artist Ali Banisadr, which sold for $477,000 against a low estimate of $286,000. Kamal Boullata’s Angelus II-I sold for almost $29,000, marking a new auction record for the Palestinian artist.

Two works by Egyptian painter Mahmoud Said were offered in the live auction, including the 1948 seascape Les falaises-la baie a Marsa Matrouh (esquisse), which the artist gave to his niece Queen Farida in the late 1940s. The painting was estimated to fetch between $80,000 to $115,000, and sold for more than $180,000. A 1919 work Le Nil a Louxor (Chadouf) by Said, meanwhile, brought in almost $70,000.

Paysage by Lebanese artist Etel Adnan sold for $159,000, while No 224 by Palestinian artist Samia Halaby fetched $217,000.

The lot also included works by Saudi artist Ahmed Mater, Iraqi artist Hayv Kahraman and Egyptian-Armenian artist Chant Avedissian. Many of the artworks were presented at an exhibition at Christie’s Dubai in September. A curated selection was also on view during Christie's London Frieze Week.

The exhibitions are likely to have helped garner international exposure for the works and bolster auction results, with the winning bidders comprising private collectors and institutions from 15 countries, including the UAE, US, UK and France. Christie’s says that 25 per cent of those participating in the auction were new clients.

“There is a much larger volume of people that are interested in art for the Middle East, internationally,” Suzy Sikorski, associate specialist of Middle Eastern Art at Christie's, says. “New people are coming in and are paying top dollar for some of these works. That was very exciting to see, the fact that there are new names in the market.”

These include international clients with little relation to the region, as well as a few institutions from the region, Sikorski says, without divulging any names.

This is the sixth year the autumn auction has been offered and the first live iteration since 2019. Sikorski says that the fact that several prices from this year’s lot exceeded initial estimates is indicative of a steadily rising demand for modern regional art, as well as more contemporary works.

“There is a mature collecting taste coming from collectors that have historically been looking at Middle Eastern art, where certain collectors have a vision of which era to focus on," she says. "But I think what’s important also is that a lot of these top value artworks are also coming from contemporary artists, which is really exciting to see. There are many collectors who are already aware, who have already had seen these works and followed them.”

Sikorski says certain sale prices, such as Boullata’s Angelus II-I, is also a sign that often overlooked names are finally getting their due attention.

“He’s a very important Palestinian artist,” she says.

Another key work sold was by Tunisian artist Hedi Turki (Plaine Fertile), who “might not have had that moment yet,” Sikorski says.

Renowned contemporary names like Ali Cherri — who had the Silver Lion award at the Venice Biennale were also featured in the lot. “He is someone that, again, is very much international — I think having those fresh young artists that are well known and respected internationally is another aspect that is slowly going to be expanding prices.”

Sikorski says there was also special focus devoted to more affordable pieces, to entice budding collectors or those still peeking into the region’s art history.

“There were many new clients that were eager to learn, many who are maybe making their first purchases from the Middle East. We have this pocket who are investing £15,000 ($17,200) or less to get their feet wet, which makes the auction seem less intimidating than they might think.”

Dr Ridha Moumni, deputy chairman of Christie’s Middle East concluded: “This year, Christie's presented a quality of artworks reflecting the diversity and creativity of the Middle East.

"We are delighted with the success of the sale and the acquisition by both private collectors and institutions from the curated selection that included significant works from Iran, Lebanon, Egypt, Saudi Arabia, and the Maghreb. We will ensure significant upcoming sales of modern and contemporary artworks and develop the category to meet the growing interest in the art of the region, regionally and internationally.”

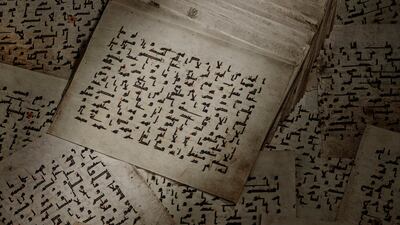

Scroll through images of Islamic and Indian works Christie's displayed in Dubai earlier this year below