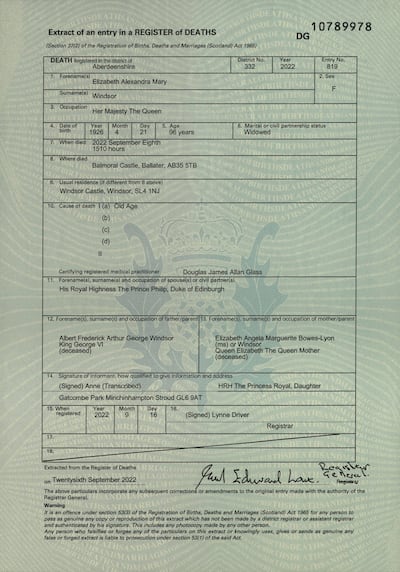

Queen Elizabeth II's cause of death was old age, her death certificate has shown.

The document, published by the National Records of Scotland (NRS) on Thursday, showed the UK monarch died at 3.10pm on September 8 at Balmoral Castle in Ballater.

The document has been signed by Princess Anne, the Princess Royal, and the cause of death is listed as old age.

The queen died at her Balmoral estate while members of her family — Prince William, Prince Andrew, Prince Edward and his wife Sophie, Countess of Wessex — were en route to see her.

Old age was the only cause of death recorded on the document. The queen stepped back from public life in the year before her death owing to health problems.

Douglas James Allan Glass is noted as the certifying registered medical practitioner.

Paul Lowe, registrar general for Scotland, said the queen’s death was registered in Aberdeenshire on September 16.

The death certificate was released on Thursday, the same day Windsor Castle was reopened to the public after her death.

Mourners are allowed to see her final resting place at Windsor.

Here is how the day of her death unfolded. At 12.32pm, Buckingham Palace said doctors were concerned about the queen’s health. She was comfortable and under medical supervision, it said.

At 12.45pm Clarence House said Prince Charles, who is now king, and Camilla, now queen consort, travelled to Balmoral. A minute later, Kensington Palace said Prince William, now the Prince of Wales, would also travel north.

At 2.39pm Royal Air Force Flight KRF23R took off from RAF Northolt in South Ruislip, west London, flight tracking website Flightradar24.com showed. The plane carried Prince William, Prince Andrew, Prince Edward and the Countess of Wessex.

At 3.10pm the queen died with Princess Anne by her side.

The plane landed in Aberdeen airport at 3.50pm.

After 5pm, a fleet of cars, including a Range Rover driven by Prince William and carrying Prince Andrew, Prince Edward and Sophie, arrived at Balmoral.

At 6.30pm Buckingham Palace said: “The queen died peacefully at Balmoral this afternoon.

“The king and the queen consort will remain at Balmoral this evening and will return to London tomorrow.”