Earlier this week, Egypt's foreign minister held the first high-level talks in six years on cooperation with the European Union, and used the occasion to warn Europe that the countries isolating Qatar would accept no compromise from Doha over their demands.

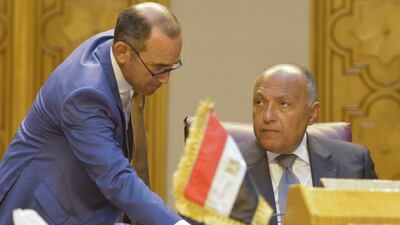

After meeting the EU's top diplomat in Brussels, Sameh Shoukry said, "We cannot compromise with any form of terrorism, we cannot compromise or enter into any form of negotiations. Qatar was "harbouring elements associated to terrorist ideologies" he added, and had used their media outlets to "promote and to justify and to glorify terrorist activity."

While the talks on Tuesday sealed Egypt's rehabilitation in Europe, where fears about security and migration have eclipsed concerns about political repression and human rights, Mr Shoukry's remarks - clearly aimed at Qatar - also underscore the stark change of fortune with its key partners in the GCC.

Late last year, it emerged that Saudi Arabia, which had spent billions of dollars since 2013 on stabilising Egypt, halted oil shipments to the country. Cairo had refused to participate in the Yemen operation led by Riyadh and also supported the legitimacy of Bashar Al Assad in Syria. Ties had also become tense with the UAE.

The crisis over Qatar, however, "has been a huge opportunity for Egypt", said Michael Hanna, an Egypt specialist at The Century Foundation in New York. "The crisis has been a huge opportunity to re-engage with the Saudis and Emiratis, their two most important regional allies and benefactors, while also joining in on a policy that seeks to isolate its primary regional foe — Qatar."

Before the current president Abdul Fattah El Sisi came to power, Doha had been the chief patron of the previous government, dominated by the Muslim Brotherhood, and relations between them had broken down since 2013, though they recovered somewhat when King Salman first took power in Saudi Arabia and sought to rally Sunni states against Iran.

"I think they're just enjoying being part of this newly emerging regional coalition, I don't think it's a good cop-bad cop situation" coordinated with the other countries isolating Qatar, Mr Hanna said.

"There's no downside — even if they're pressing [rhetoric] in maximalist ways beyond where the Saudis and Emiratis are, they have cover to do this in a way that they didn't before," he added. "Not that this is going to change the European outlook on the crisis, because it's just not."

While Egypt is seen as an important actor in European-led efforts to foster political reconciliation in Libya, analysts said cooperation in that sphere is separate from the Gulf crisis, where European powers are hoping for a negotiated resolution with Doha, a key economic partner and energy provider.

The Gulf crisis is "comparatively low on the list of what the EU is looking to Egypt for at the moment," said Anthony Dworkin, a North Africa analyst at the European Council on Foreign Relations.

After meeting with Mr Shoukry, the EU's top diplomat, Federica Mogherini, said it was Europe's view that not one, but all countries had to work harder at fighting terrorism. hat Kuwait-mediated talks "should start as a matter of urgency,"she added. In the meantime, "The EU will continue to have good relations with all the countries involved."

No compromise on Qatar demands, Egypt tells EU

Foreign minister Sameh Shoukry reiterates position as Cairo re-establishes high-level ties with Europen after six years

Most popular today