The possible suspension of uranium enrichment by Tehran was not discussed at a weekend meeting of major countries in Geneva, Iran's nuclear negotiator Saeed Jalili said on his return today. Iran faces a two-week deadline to give a final answer to world powers seeking a breakthrough in the nuclear crisis, after talks with the EU foreign policy chief ended in stalemate. "The question of suspending enrichment was not discussed in Geneva, there were discussions on the different parties' approach to the continuation of the negotiations, their setting and their calendar," the official news agency IRNA quoted him as saying.

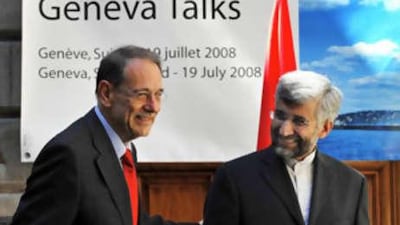

Mr Jalili and the EU's top diplomat Javier Solana hailed their latest talks as "constructive" but Mr Solana lamented that Tehran had still not given a final response. The Iranian President Mahmoud Ahmadinejad described the talks as a "step forward" in the nuclear standoff, which has raised fears of regional conflict and sent oil prices spiralling. Mr Solana, who presented Iran with a major package aimed at ending the standoff on behalf of world powers last month, said he was waiting for a decision from Tehran on an initial deal to start pre-negotiations.

This would see world powers promising not to impose further UN Security Council resolutions against Tehran, in exchange for Iran not installing any more uranium-enriching centrifuges, he said. "We have not got an answer to the most important issue... we are looking forward to an answer to these questions in a couple of weeks," said Mr Solana. Mr Jalili said today: "We agreed to work on this question and to resume the discussions in two weeks. We put forward a precise plan and a road map for the pursuit of the negotiations."

In a major development, the Geneva talks were also attended by the third most senior diplomat from the United States, William Burns, the first time Washington has had direct contact over the nuclear standoff with Tehran. However, the United States warned Iran would face "confrontation" - an implicit warning of further sanctions - if it failed to suspend uranium enrichment, which the West fears could be used to make a nuclear weapon.

Iran has already been hit by three sets of UN sanctions over its refusal to suspend uranium enrichment, while the United States and European Union have imposed unilateral measures against its banks. Iranian officials have repeatedly said they have no intention of freezing enrichment - the key demand of world powers for ending the crisis. Iran denies seeking nuclear weapons, insisting its programme is designed to provide energy for its growing population when its reserves of fossil fuels run out.

*AFP