When Dhruv Meisheri was in grade 10, he realised that his curriculum did not offer lessons on personal finance or how teenagers can earn passive income.

The teenager, a pupil at the Dubai International Academy in Emirates Hills, learnt about stock investing from his father and bought his first stock at the age of 12.

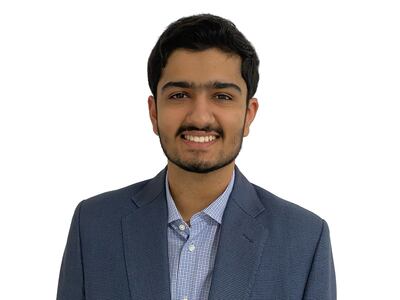

“Since then, with guidance from my father and a few others, I have been able to expand the depth of my knowledge in the finance world and get a good foundational understanding on how to pick stocks,” Dhruv, now 17, says.

“I haven’t been trading a lot lately because I am in the final year of high school. Until when I stopped, I had been earning a considerable amount of passive income from my portfolio. I started with the Indian stock market and progressed to the US market.”

Dhruv, who aspires to become an investment banker, decided to set up a competition for high school pupils that gives them the resources to learn about stock-picking methods and investing.

He unveiled the Young Investors Competition (YIC) in 2021 as a platform where pupils can showcase their financial literacy skills.

“I felt there was a need to help teenagers earn income from an early age since this will help them as they progress in their careers. Even if they don’t win the competition, they will learn a thing or two about investing by participating,” Dhruv says.

Early financial education can help to foster strong money management skills in adulthood, experts say.

But personal finance education is rarely on the curriculum at schools and universities, with youths often relying on their parents to teach them vital lessons about managing money.

As a result, it leads to poor personal finance skills in the long term.

Fifty-nine per cent of the 2,046 adult Americans polled in a Charles Schwab Financial Literacy survey in 2020 cited the value of saving money as a key lesson to be taught to children.

This was followed by the need to teach basic money management skills (52 per cent) while 51 per cent of respondents listed the setting of financial goals and working towards them as important.

On a scale of one to 100, the respondents rated money management (62.9 per cent) as the most important skill for children to learn. About 63 per cent of US adults also chose financial education as the most important supplementary graduation requirement to maths, English and science, the survey found.

The YIC has partnered with the Financial Freedom Programme, a non-profit organisation in California that helps the Gen Z cohort to learn about finance, and offers its curriculum on investing and finance as resources to prepare participants.

The contest is focused on youths between the ages of 13 and 18. They cannot be in university because they would have a slight edge over high school pupils, Dhruv says.

Pupils can register in teams of two to four members to participate in the competition. You can have teammates from anywhere in the world, he says.

Registrations close on March 30.

The teams are given a case study based on which they must tailor an investment portfolio. Participants will be judged on how they analyse a client’s objectives, risk tolerance and investment style.

“More than being able to pick the right stocks, participants should be able to justify their investment choices. Past winners were able to correctly identify the client goals and produce a portfolio that adheres to those goals,” Dhruv says.

Participants can use FFP resources to get a brief overview on how to approach investing and learn the basics.

They also need to do their own research and find stock-picking strategies that they are comfortable with and can justify, Dhruv says.

Participants can also go through the presentations submitted by past winners to learn their investment strategies and the metrics used to analyse a company.

They can choose the best parts and incorporate them into their own presentations, he says.

The competition will have a four-member judging panel comprising established people who already work in the finance industry.

The contest will feature two rounds. Dhruv and a few other business-savvy pupils will initially review the submitted presentations. They will evaluate the submissions and choose the top 10 participating teams, who will then present to the judges.

“For the first round, an average person will need about 10 to 15 hours of preparation in total to make the presentation,” Dhruv says.

“This depends on how well they can delegate tasks within their team and how they work in general. We give the shortlisted teams two to three days to make aesthetic changes to their presentations, but they cannot change the core strategy.”

From the time the first case study is released to the announcement of winners, the competition will last for about three weeks.

Participants must keep abreast with the news as the judges are familiar with the global stock markets, Dhruv says.

Participants should also research good investment approaches rather than come up with their own strategies. This competition will not test you on the uniqueness of your strategy, but whether you can pick good stocks, he says.

founder of the Young Investors Competition

The first YIC competition had participants from more than 25 countries. This year's contest has received entries from 250 teams from 15 countries so far.

While Dubai Investments was the sponsor of the competition last time, they have teamed up with education consultancy Hale Education this year.

“We are awaiting confirmation for an internship. If the winners are from the UAE, there is a high chance that they could be able to do it in person. If not, there could be a remote internship,” Dhruv says.

The competition offers cash prizes collectively worth $5,000 for three winners. It will also give free Hale consultancy sessions for each person in the top three winning teams.

“They can leverage these sessions to get admission in a university of their choice,” Dhruv says.

He eventually plans to develop a chapter system for the competition. He intends to set up YIC chapters in different schools and elect a president in each school to be in charge of helping pupils with financial literacy.