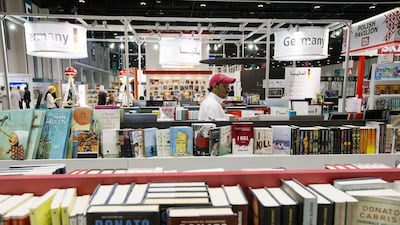

The Abu Dhabi International Book Fair began its 26th chapter yesterday with Emiratis and expatriates alike leafing through the thousands of books available. Photos: Christopher Pike

Abu Dhabi International Book Fair gets under way - in pictures

Most popular today