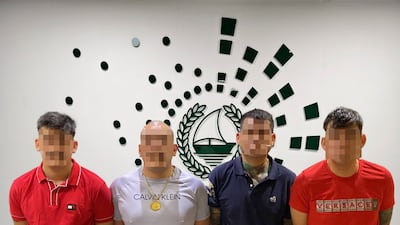

Dubai Police arrested a gang who are believed to have carried out burglaries on several villas after flying into the emirate on tourist visas.

The force said the four-man gang, whose identities were not revealed, are alleged to have carried out eight burglaries in different areas of the emirate when the owners or occupants of the villas were overseas on holiday.

The four managed to steal gold jewellery, expensive watches and cash valued at Dh2 million before leaving the UAE.

They later returned to the Emirates and stole Dh60,000 ($16,337) in cash, after which they were arrested.

Dubai Police

Dubai Police said they managed to identify the four gang members, who were from a Latin American country, within 12 hours of receiving the reports from villa owners, who discovered their homes had been burgled after returning from their holidays.

Maj Gen Jamal Al Jallaf, director of the Criminal Investigation Department at Dubai Police, said the gang travelled to a country in the Middle East before heading to another country through land borders.

“We predicted the gang would return to the UAE because they didn’t travel to their home country,” Maj Gen Al Jallaf said on Thursday.

"After one month, the gang returned through Dubai International Airport but we didn’t arrest them immediately and kept them under intense monitoring.

"After a week of monitoring, the gang decided to go with a different style of crime, away from villa raids when they noticed most of the villas were secured.

“They moved from residential areas to commercial areas and started monitoring banks and exchange offices. They stole Dh60,000 from a bank customer and returned to their hotel.”

Just before the start of Ramadan, a special Dubai Police Swat team raided the place they were staying and arrested the gang.

The gang, who admitted carrying out the burglaries, told officers that they monitored the lights in the villas before sunset for a day or two. If the lights remained off, they returned at night and raided the villa, knowing that there was nobody inside.

After climbing over the villa walls, they used a sharp tool to prise open the doors.

Col Adel Al Joker, assistant general director of the General Department for Criminal Investigation Affairs, said the force managed to recover some of the stolen valuables.

“The problem was the villa owners were out of the country and reported the incidents [only] after the gang had left,” Col Al Joker said.

"Despite that, we managed to identify them because they were using a rented car to travel around the emirate.

“Smart cameras identified the gang when they entered the country through Dubai International Airport one month after they committed their crimes.”

He said the gang wanted to raid more villas but they hesitated when the properties in many areas had powerful lights, cameras and signs showing the residential area was monitored by surveillance cameras.

“They decided to target bank customers,” Col Al Joker said.

"A victim who went to his car with Dh60,000 was distracted by the gang who punctured the tyre and stole the money when he stepped out of the car to check the tyre."

Dubai Police urged residents to sign up for the force's free home security service, which allows villa residents to register with the force when they are out of the country.

The sophisticated system links security cameras and motion sensors placed in homes with the force's control room, allowing officers to take swift action when intruders strike.

Residents can sign up through the Dubai Police app or online to notify officers when they will be away for prolonged periods so their homes can be monitored.

Homeowners can also track surveillance footage on their phones.