The second-longest ancient papyrus — or long piece of inscribed ancient paper — to be discovered in Egypt was unveiled at a ceremony on Monday at Cairo’s Egyptian Museum.

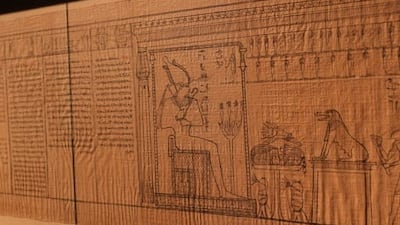

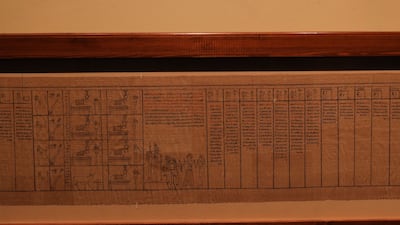

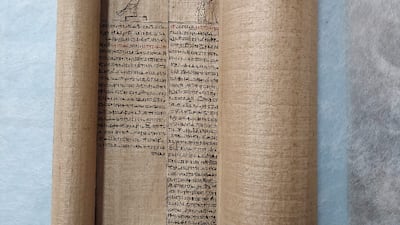

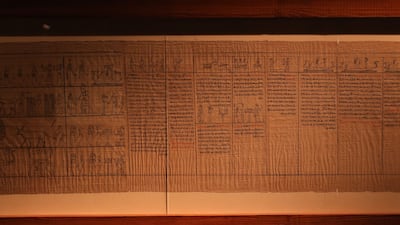

Waziri Papyrus I measures more than 16 metres in length and is inscribed with verses from the Egyptian Book of the Dead. It was excavated in May 2022 by an all-Egyptian mission working at Cairo’s Saqqara necropolis.

The book is a collection of spells believed in ancient Egypt to assist a dead person on their journey through the underworld.

Despite being announced last year, it had not been seen by the public until Monday night when it was unveiled inside a new exhibit at the Egyptian Museum in Tahrir Square by Mostafa Waziri, the Secretary General of Supreme Council of Antiquities, after whom the papyrus was named.

It had been undergoing restoration since May, Mr Waziri told reporters at Monday’s ceremony.

Unearthed within the sarcophagus of a person named Ahmose, the papyrus, which dates back to 50BC, is inscribed in hieratic, a form of ancient Egyptian shorthand used predominantly by priests, and comprises 13 sections from the Book of the Dead.

The verses were inscribed on the papyrus as 150 columns of writing of varying lengths and were accompanied by hieroglyphics and illustrations.

Ahmose’s name was found 260 times on the papyrus, which led the team to believe that it was meant as his personal funerary document.

Furthermore, another papyrus was found at Saqqara more recently and it is now in restoration, and would be unveiled soon, Mr Waziri said.

It will be named Waziri Papyrus II.

The unveiling took place as part of a larger ceremony held to inaugurate a newly updated wing of the Egyptian Museum which had been undergoing renovation co-funded by the EU.

The renovation plan, the first phase of which has been completed, involves major structural updates to the 120-year-old premises and improvements to its lighting systems and displays. Additionally, its archives and services will be digitised, Mr Waziri said.

Egyptologists from several Egyptian universities attended alongside counterparts from five European museums with large ancient Egyptian collections: the Louvre, the British Museum, the Egyptian Museum in Berlin, the National Antiquities Museum in Leiden, in the Netherlands, and the Egyptian Museum in Turin.

The foreign contingent present at the inauguration of the renovated wing at the museum, praised their “longstanding and fruitful co-operation” with the Egyptian Museum.

The redevelopment was undertaken to ensure the Egyptian Museum, the country’s oldest, is not forgotten now that newer, larger and better-equipped alternatives such as the Grand Egyptian Museum and the National Museum of Egyptian Civilisation have opened to visitors, said Ahmed Eissa, Minister of Tourism and Antiquities.

Mr Eissa announced a plan in January to increase tourism by 30 per cent by updating the quality and speed of services offered to tourists.

“Museums and tourists’ experience inside them is an important part of our plan to boost tourism,” said Mr Eissa during his address on Monday.

The inauguration ceremony was also attended by the European Commission’s ambassador to Egypt, Christian Berger. He outlined the prominence of the Egyptian Museum, which opened in 1902 and has played an important role in the preservation of the country's heritage.

The longest papyrus to be discovered in Egypt, the Harris Papyrus I, was found near Luxor’s Habu Temple in the 1850s.

It was purchased by a British collector in 1855 and has since been displayed at the British Museum.