Saudi Arabia's Crown Prince Mohammed bin Salman on Wednesday announced a new tourism master plan for Al Ula in the country's north-west.

The Journey Through Time master plan aims to turn Al Ula into a global destination for travellers offering heritage, nature, art and culture. When completed, the plan hopes to attract two million visitors every year to the historic Saudi region.

Prince Mohammed's plan will turn the Al Ula region into a "living museum" by immersing travellers in 200,000 years of natural and human history.

With a focus on sustainable tourism, a key part of the scheme is the creation of a low-carbon tram line that connects five distinct districts across the region. This tramway will follow a similar route to the ancient one running along the Hijaz Railway, used by pilgrims for hundreds of years. Other options to encourage sustainable travel will include a series of bicycle paths, extensive pedestrian trails and far-reaching equestrian tracks for low-carbon journeys.

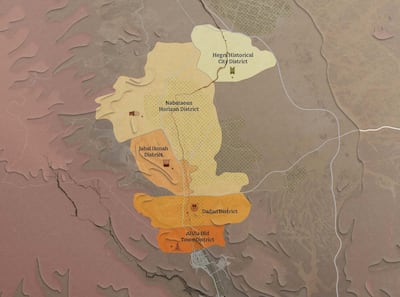

The Journey Through Time will take travellers from Al Ula Old Town and neighbouring Dadan, to the open-air wall-carvings at Jabal Ikmah and onwards to the Nabataean Horizon and Hegra historical city, dedicated to Saudi Arabia's first Unesco World Heritage site.

A 20-kilometre Wadi of Hospitality

At the heart of Al Ula's desert landscape is the region's palm oasis. The new master plan proposes a 20-km Wadi of Hospitality to be created to run along this ancient oasis bed.

This area will act as the green pedestrian "spine" and will be home to restaurants, museums and other interactive attractions that will see visitors go to local farms, pick dates and learn more about the culture while enjoying the beauty of the oasis.

"It's going to be a very special place in Saudi Arabia, but also a place for visitors from around the globe who are interested in learning more about different cultures and multiple civilisations.

"It's a good reason for people to come and appreciate what we have to offer, and educate themselves in a way that will make a visit very memorable," says Phillip Jones, chief destination marketing officer of the Royal Commission for Al Ula.

The plan has no shortage of attractions, proposing that 15 new cultural assets such as galleries, museums and cultural centres be constructed across the districts. A 9-km Cultural Oasis will be home to a host of visitor experiences including living gardens, an Arts District, and the Perspectives Galleries. There are also plans for 10 million square metres of greenery and open spaces.

"Travellers will begin the journey at Al Ula Old Town, which is already up and running, and then there's the oasis and the wadi which will give people 20km to walk or ride and enjoy the regenerated wadi. And then travellers can take eco-friendly transportation through the entire area, to Dadan, Ikmah and on to Hegra, which is ultimately where the journey ends," explains Jones.

"Every stop along the way will give you a story, and you'll be able to learn about the civilisations that have left their mark over the last 200,000 years."

As part of the plan, Al Ula's hotel scene also gets a boost with an additional 5,000 rooms and suites to be built across the region. Lodgings will offer a variety of accommodation options including luxury hotels, canyon farms, stays and ecotourism resorts.

The announcement also set out the plans for The Kingdoms Institute. Located in the oasis of Dadan, it will become one of the cultural centres of Saudi Arabia and a global hub and learning centre for archaeological research about the civilisations that have inhabited Al Ula. The design of the cluster of buildings making up The Kingdoms Institute is inspired by the Dadan civilisation, and they will appear as if carved in the mountains opposite the archaeological site of Dadan.

Learning from the past, planning for the future

While the master plan takes guests on a journey through time from ancient civilisations and pilgrimage routes, to modern carbon-free tramways, it also places importance on protecting tomorrow.

The master plan includes the Al Ula Sustainability Charter, which ensures that all development happens alongside an innovative and integrated approach to sustainability. The charter includes a zero-carbon policy coupled with circular economy principles, and robust resiliency policies around development in heritage and environmentally sensitive areas, as well as flood and improved water management and vegetation planting.

Al Ula residents, who have acted as guardians of ancestral values, techniques, and traditions over millennia, are an integral part of the new master plan. As well as helping to boost local economies, the plan includes community-driven services and amenities including cultural and educational facilities to be constructed across each district.

Laid out in three phases, the master plan is set for completion by 2035, but the first phase is on track to be completed by 2023. Over the next 14 years, the Journey Through Time master plan will create 38,000 new jobs across Al Ula and add 120 billion Saudi riyals ($32bn) to Saudi Arabia's gross domestic product.

By 2035, 80 per cent of Al Ula County will also have been designated as nature reserves, with key indigenous flora and fauna reintroduced across the region.