The US is “building a coalition” and will take “every step” to deter Yemen’s Houthi rebels from carrying out attacks in the Red Sea, US National Security Adviser Jake Sullivan said in Tel Aviv on Friday, after the rebels struck two ships in the strategic waterway.

Mr Sullivan’s warning came a day after western diplomats told The National that the US and its allies were studying options to respond to Houthi attacks on Israel-linked ships in the Red Sea, including strikes in their country.

The Iran-backed Houthis have attacked several ships, claiming they were linked to Israel, in support of Hamas. In some cases however, the ships had no clear connection to Israel and at least two were carrying cargo to Italy and a destination in northern Europe.

“The Houthis represent a material threat to freedom of navigation to commercial shipping to lawful commerce, and they're doing so in a vital artery," Mr Sullivan told reporters after meetings with Israeli officials.

“We are building a coalition. We are working to ensure that we rally the nations of the world, all of whom have an interest in seeing this stop.

“This is not about the United States and Israel. This is about the entire international community. And we will continue to take every step that we deem necessary and appropriate to deal with the threat that the Houthis pose.”

Houthi escalation risk

A diplomat involved in Yemen’s peace talks told The National earlier that “western security agencies and diplomatic missions … are studying together with other intelligence agencies how to respond to this increasing threat in the Red Sea, including possibly conducting targeted air strikes”.

On Thursday, Pentagon press secretary Brig Gen Pat Ryder said the US and partners were working to bolster a maritime task force to address the Houthi threat, despite Tehran warning that any proposed multinational task force would be “challenged”.

Meanwhile, the International Chamber of Shipping told The National that more warships are needed in the Red Sea where the US Navy leads multinational task forces, to prevent the escalating Houthi attacks on merchant vessels.

The body that represents nearly all merchant shipping warned that the rebels have become increasingly indiscriminate in launching missiles and drones at ships, with the latest attacks on vessels on Friday.

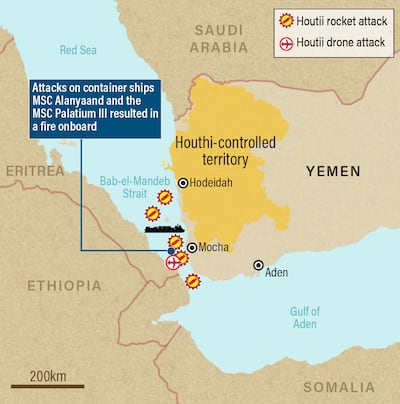

A US defence official said that attacks from Yemen struck two Liberian-flagged ships in Bab Al Mandeb.

US Central Command later said in a statement posted on X, formerly Twitter, that "forces maintained direct communications with the vessel" and stated the Liberian-flagged Alanya ship "is believed to be travelling safely at this time".

A projectile, believed to be a drone, struck one of the vessels, the German-owned Al Jasrah, causing a fire but no injuries, the official said. Two ballistic missiles were fired in the second attack, one of which struck a vessel, causing a fire, which was eventually extinguished.

It also said the USS Mason destroyer had assisted with the Liberian-flagged MSC Palatium III ship after it issued a mayday call for a fire on board.

The Houthis confirmed in a statement that they carried out "a military operation against two container ships", adding that the ships "were targeted with two naval missiles".

"No injuries have been reported by any of the three ships attacked, but this latest round of attacks is yet another demonstration of the great risk to international shipping caused by these Houthi actions," the Centcom statement concluded.

In the months running up to the current war in Gaza, there had been relative optimism over the prospects of a peace deal in Yemen, which has been ravaged by one of the world's worst humanitarian crises.

Yemen's warring parties were considering a broader ceasefire to allow for crucial peace talks. But the Houthis' actions in support of Hamas in Gaza are jeopardising the process, Yemeni officials have said.

Fighting in Yemen was curtailed by a UN-brokered ceasefire in April last year, despite the truce expiring six months later. In September, Saudi Arabia hosted Houthi representatives for several days of talks, in the first public official visit by a Houthi delegation to the kingdom since the beginning of the war in 2014.

Despite the risks, the Houthis have vowed to continue their attacks in the Red Sea and attempts to strike Israel with drones and missiles as long as the war continues in Gaza, where more than 18,400 Palestinians have been killed in Israeli strikes and shelling since October 7.

On Friday, a Houthi senior official said the Red Sea waters, a strategic route for tankers and cargo ships, “is safe for international trade movement, with the exception of the Zionist enemy’s ships or those sailing to and from its ports, until the aggression against the Palestinian people in Gaza stops, and their food and medicine needs are brought in”.