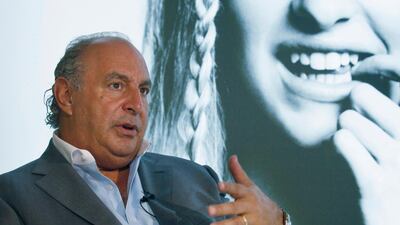

Sir Philip Green’s Arcadia has adjourned a crunch creditors' meeting to stop the sprawling fashion empire - which includes Topshop - from tumbling into administration.

In a statement, the group said it decided to adjourn the meeting on Wednesday until June 12 to enable further discussions with landlords, "with a view to securing a final decision on the seven Company Voluntary Arrangement (CVA) restructurings."

The restructuring involves store closures and rent cuts.

If the CVAs are voted for, they will provide a stable platform for Arcadia’s leadership team to implement their turnaround plan and ensure the long term sustainability of the group, its 18,000 employees and its extensive network of loyal suppliers.

So far, Arcadia has secured the support of the pension trustees, The Pensions Regulator and the Pension Protection Fund, as well as the full backing of its trade creditors and a significant number of landlords.

However, there were reports that indicated the company was concerned that it would not receive the landlords' backing and save itself from administration.

Ian Grabiner, CEO of Arcadia, said: “It is in the interests of all stakeholders that we adjourn today’s meetings to continue our discussions with landlords. We believe that with this adjournment, there is a reasonable prospect of reaching an agreement that the majority of landlords will support.”

Earlier on Wednesday, the company won the backing of Britain’s pensions regulator ahead of the crucial meeting.

Sir Philip agreed to a £385 million (Dh 1.79 billion) deal with the Pension Protection Fund (PPF) to cover the deficit in Arcadia’s pension schemes.

The agreement includes a £100m contribution from his wife Tina Green and the company’s main shareholder over three years. The company also agreed to contribute £75 million.

If the CVA receives the backing of the creditors, Arcadia will be able to reach an agreement with lenders to repay its corporate debt and avoid insolvency.

Arcadia owns Topshop, Topman, Burton, Dorothy Perkins, Miss Selfridge, Wallis and Evans.

“We’ve been working hard with the Pensions Regulator and scheme trustees to ensure that Arcadia increases the funding of the pension schemes to a level that will provide for the members and protect the PPF," said Oliver Morley, chief executive of the PPF.

"Following these negotiations, we are pleased that the company and shareholder have today agreed a funding and security package for the scheme."

The PPF is the largest creditor in the CVA, but other creditors will also need to agree to the terms for it to be successful.

"We therefore want to reassure pension scheme members of the continued protection the PPF gives them,” he said.

On Tuesday, Arcadia said it would provide £210 million pounds of security over assets for its pension schemes, including an additional £25 million pounds to help close a funding deficit as agreed with the Pensions Regulator (TPR).

The Pensions Regulator had previously told the billionaire to increase his contribution if they were to support a CVA for the company.