Google is set to launch its first foldable smartphone in June in what could be a direct challenge to the dominance of market leader Samsung Electronics.

The technology company is set to unveil what is being called the Pixel Fold, a 7.6-inch inward-folding device similar to Samsung's flagship Galaxy Z Fold series, at its I/O industry conference on May 10, CNBC reported, citing internal documents.

It will also come with a 5.8-inch cover screen, smaller than the Galaxy Z Fold's 6.2-inch design, it said.

Expectedly, the price is at a premium: The Pixel Fold, internally known as “Felix”, is said to cost at least $1,700, making it the most expensive in the Pixel line-up and well within range of the Galaxy Z Fold's $1,799.

South Korea-based Samsung also has its lower-tier Galaxy Z Flip, the current iteration of which starts at $999.

Google declined to comment to The National.

The growth in popularity of foldable smartphones has been largely attributed to Samsung, which pushed the category into the mainstream, starting with the original Galaxy Z Fold in 2019.

While the category is growing, it still accounts only for a marginal share in the overall smartphone sector.

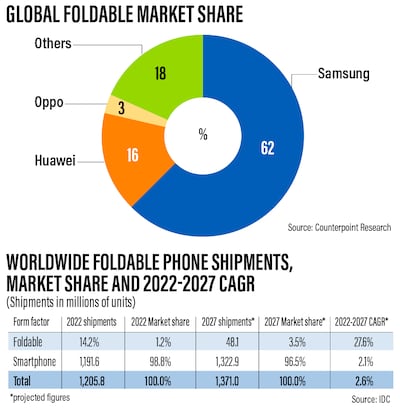

Foldables held a 1.2 per cent market share in the industry, with 14.2 million units shipped in 2022, while traditional smartphones accounted for 98.8 per cent of the total, with more than 1.19 billion shipments last year, according to the International Data Corporation.

However, by 2027, foldable shipments are expected to jump to 48.1 million units at a compound annual growth rate (CAGR) of 27.6 per cent, compared to a CAGR of 2.1 per cent for traditional devices, whose shipments are set to rise to 1.32 billion, it said.

That would make the market share of foldables increase to 3.5 per cent, the IDC study showed.

Foldable devices remain niche but their uniqueness and the new user experience they offer could be a key selling points for users, the IDC said.

“Foldable devices currently bring that 'wow factor' and I believe they will continue to grab more headlines and outperform non-foldable smartphones over the next five years,” said Nabila Popal, research director at the IDC's Worldwide Tracker team.

Google's launch of the Pixel Fold would be the culmination of years of speculation. It first announced foldable screen support for its Android mobile operating system in 2018, then followed it up with patent filings for foldables in 2019.

While the move will provide a boost to Google's Pixel smartphone line-up, taking on Samsung could prove to be a tall order.

The Korean company, the world's biggest mobile phone manufacturer, holds a 62 per cent market share in the foldable category, way ahead of second-placed Huawei Technologies, the latest data from Counterpoint Research shows.

Huawei, Oppo, Xiaomi and Vivo, all based in China, have all introduced foldables but they are mostly limited to the Chinese market.

Motorola, the maker of the famous Razr flip phone that has been relaunched as a foldable, may be the only contender, for now, in markets such as the US, where the Pixel line-up is concentrated, Counterpoint had previously said.

Meanwhile, rumours about Apple's foray into the segment have been swirling for several years now, with speculation about a foldable iPhone growing when Samsung and Huawei first released their first folding devices in 2019.

research director at the International Data Corporation

California-based Apple has filed patents for devices with foldable displays, as reported by data tracking website Patently Apple.

Bloomberg's Mark Gurman, a reliable source when it comes to insider news at Apple, has also suggested that the company may be working on a foldable iPad.

“More models from both new and current vendors are expected to bring further improvements and enhancements to the category to help drive continued adoption,” the IDC said.

The Pixel Fold will run on Google's Tensor G2 chip, which is found in the latest Pixel 7 devices, and will be water-resistant, the documents viewed by CNBC showed.

It will also have a larger battery that will enable it to last for 24 hours and up to 72 hours using low-power mode, the report said.