Global funding for the insurance technology sector posted a modest recovery in the second quarter of 2022, but is still down more than half from a year ago, a report from reinsurance company Gallagher Re has shown.

While funding rebounded by about 9 per cent to $2.41 billion from April to June, from $2.2bn in the first quarter, the level of investment in the three-month period ending June 30 was still 50.2 per cent below the $4.84bn the sector recorded in the second quarter of 2021, which was its second-best on record, the London-based advisory said in its quarterly update.

A total of $948 million was raised in the second quarter through six mega rounds, including four based in the US, with average deal size rising 18.3 per cent quarterly to about $22.1m, the report said.

The total was about 43 per cent higher than the first quarter's $668m. This was offset by a 7.7 per cent decline in total deals 132 in the second quarter, from 143 in the first three months of the year.

With stock markets on the downside, insurance technology companies are poised to deliver growth and profitability in the long term, and are an “excellent opportunity” for investors to diversify their portfolios, said Andrew Johnston, global head of InsurTech at Gallagher Re.

“A number of [InsurTechs] will undoubtedly change the face of our industry, or parts of it and, in some cases, are already doing so. As markets begin to recover, those InsurTechs should rise to the surface with the utmost buoyancy.”

The demand for InsurTech solutions is rising as it helps predict consumer demands, increase purchasing quantities, as well as enhance decision-making and insurance planning through the use of machine learning, artificial intelligence and cloud computing, according to Future Market Insights.

The global InsurTech industry is expected to hit $165.4bn by 2032, from about $16.6bn in 2022, at a compound annual growth rate of about 26 per cent, it said.

In 2021, the InsurTech sector recorded $15.8bn raised in funding, a record high, from 564 deals, as more capital flowed into the industry last year than in 2020 and 2019 combined, Gallagher Re said in April.

Total disclosed funding for life and health InsurTech hit $918m in the second quarter of 2022, which is a 12.4 per cent quarterly rise, with deals growing to 40, from 37, during the period, Gallagher Re said. The average deal size was $24.8m for the quarter, with about 58 per cent for companies focused on lead generation or distribution.

Funding in the property and casualty segment was also up, rising about 6 per cent quarterly to $1.49bn, although deals were down 13.2 per cent. The average deal size for the quarter was $20.73m, and the bulk of transactions was between companies focused on distribution and business-to-business operations.

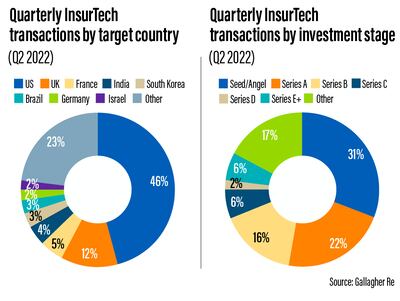

US-based InsurTech companies concluded 60 deals — their highest — in the second quarter, making up 46 per cent of the market.

There was a big increase to the UK's share, which was the only other country to record a double-digit market share of more than 12 per cent.

Gallagher Re said that the InsurTech industry remains a viable investment alternative, especially given shaky economic conditions. Technology's potential to improve insurance services is also an attractive proposition.

Market participants are “nervous about overall global economic growth”, the company said, citing high oil prices, the war in Ukraine and a sharp rise in Covid-19 cases in China.

The recent downgrade of company values could lead to mergers, acquisitions and divestitures that were unlikely six months ago, Mr Johnston said.

“It has caused some InsurTechs to coalesce, and thrown cold water over many other InsurTechs that previously considered themselves special or unique,” he said.

“After value realisation, certain InsurTechs should offload and certain investors — even certain InsurTechs — should acquire. For both sides of the trade, this moment could be seen as an enormous opportunity.”