Bang Si-hyuk

The shares of Big Hit Entertainment, the company behind South Korean boy band BTS, began trading last week. A top-of-the-range listing valuation of $4.2 billion implies solid profits and institutional investors have piled in.

To live up to the hype, billionaire founder Bang Si-hyuk needs to turn a one-band wonder into something closer to Universal Music Group, adding artists and spreading their hits widely.

An alternative would be to expand into many other forms of Korean content already grabbing the attention of consumers such as television dramas, cinema, gaming and more.

Thanks to social media, BTS is arguably the first band to resonate with western audiences.

A formidably active fan base means the band holds the Guinness World Record for Twitter engagement, based on average retweets.

There is little debate over whether BTS is a lucrative musical phenomenon – their latest album was the fourth in under two years to reach the top of the US Billboard 200 chart, and the group’s first all-English single went straight to number one.

Its live concert popularity remains undimmed by the pandemic: a streamed performance in June attracted a record 756,000 viewers from more than 100 countries.

The bigger question is whether the band’s manager is worth a celebrity price. Big Hit’s dependence on the band strikes a dissonant note and while it has other idols, BTS accounted for about 90 per cent of sales in the first half.

Still, even superstars have a lifespan. The seven-man group officially made their debut in 2013. The Beatles, whose popularity is often a point of comparison, lasted less than a decade.

Considering estimated net debt and annual profit before interest, tax, depreciation and amortisation as provided in the listing prospectus, a debut price of 135,000 won ($117) a share puts the company’s enterprise value at more than 40 times this year’s Ebitda.

That is well above local rivals such as SM Entertainment, JYP Entertainment and YG Entertainment, which trade at an average of closer to 22 times the Ebitda forecast.

It is above Warner Music Group too, and there are expectations of breakneck growth.

Anil Agarwal

About a year after Anil Agarwal’s bid to amass the biggest stake in Anglo American ended with a whimper, shareholders scuttled the billionaire’s plans to wrest greater control of his Indian commodities unit. He may appease them with larger dividends, according to analysts.

CLSA India predicts Vedanta could offer a high dividend, a positive for minority shareholders who last week rejected Mr Agarwal’s attempt to take the company private. The payouts could also help parent company Vedanta Resources, which is based in London, to reduce its debt load, which was one of the goals of the proposed delisting.

The failure of the plan to withdraw Vedanta from India’s two main stock exchanges comes after a series of moves by Mr Agarwal to simplify his investments. These include the delisting of Vedanta Resources in 2018 and the merger of Cairn India Holdings with the Mumbai-listed unit.

The group had also faced a backlash last year when analysts downgraded it after its subsidiary bought an economic interest in Anglo American for $200 million.

Mr Agarwal exited that investment after raising expectations that he may push for a major change such as a takeover or break up.

“Mr Agarwal has been in the eye of the storm, first for corporate governance, then for merging unlisted Vedanta companies, so investors were really angry with him,” said Sanjiv Bhasin, director at IIFL Securities.

“The stock has immense value, and the business has turned [around]. Astute shareholders will not sell the share at a discount.”

Vedanta Resources plans to begin returning funds it raised from banks and bondholders to finance the delisting.

In addition to the principal, Vedanta will also pay a small amount of interest on the $1.1 billion loan.

The founders had also raised $1.4bn via bonds to fund the share buyback, Bloomberg previously reported.

Vedanta has yet to make any decision on whether it will propose a delisting again.

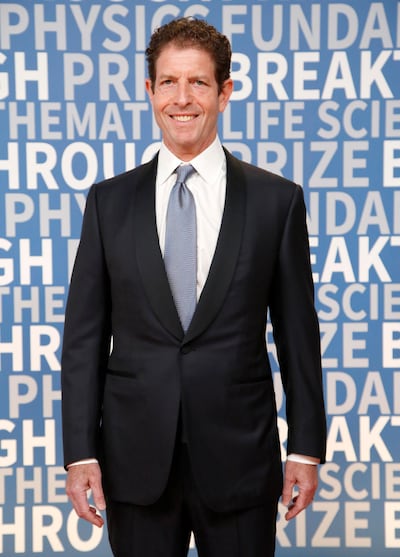

Daniel Och

Daniel Och and Glenn Fuhrman have created a blank-cheque company, joining a growing list of hedge fund managers, venture capitalists, former bankers and sports stars raising money for potential investment.

The duo seeks to raise $750m for a special purpose acquisition company called Ajax I, according to a registration statement, which will cast a wide net for deals and primarily focus on businesses in software, FinTech and the consumer industry.

Mr Och built a fortune through Och-Ziff Capital Management Group, which was once the largest publicly traded hedge fund manager in the US.

He pulled most of his capital from the fund in 2018 after a years-long slide in its share price.

He set up his family office, New York-based Willoughby Capital, more than a decade ago to manage his investments.

Meanwhile, Mr Fuhrman helped found billionaire Michael Dell’s family office and shaped it into one of the most sophisticated of its type globally before stepping down at the end of last year.

Those on the board include Instagram founder Kevin Systrom, Anne Wojcicki who started 23andme and Chipotle Mexican Grill founder Steve Ells, the filing shows.

More than 100 of these blank-cheque companies have gone public this year, raising more than $40bn on US exchanges, more than half the total raised in all previous years combined.

Those starting SPACs this year include Bill Ackman, venture capitalist Chamath Palihapitiya and Bill Foley. The entities provide a way for businesses to go public without going through an initial public offering.

Lex Greensill

Billionaire Lex Greensill’s company is considering raising capital as its banking arm faces regulatory scrutiny and many of its clients endure financial difficulty this year.

Greensill Capital, a provider of supply chain finance, said it may look to raise funds that could value it at $7bn. That would double the valuation it achieved a year ago, according to Dow Jones. The finance company did not specify how much it could seek to raise.

Greensill Capital specialises in extending short-term loans to companies secured against invoices.

Many of those loans are then packaged into funds run by Credit Suisse Group and GAM Holding, meaning that much of its lending is funded by investors hungry for yield and the security of short-term debt.

Mr Greensill, a former Morgan Stanley banker, established the company in 2011.

“The Covid-19 pandemic has accelerated our growth trajectory over the last few months and increased the demand for our technology-led working capital solutions,” a Greensill Capital representative said.

“A potential capital raise would enable us to accelerate the execution of that strategy.”

The company has also been in the spotlight for reasons other than growth. German financial regulators are examining a bank the company owns in Germany over its large exposure to assets linked to British-Indian entrepreneur Sanjeev Gupta.

Supply chain finance funds run by Credit Suisse, which invest solely in assets sourced by Greensill Capital, have suffered client withdrawals while companies it has helped finance, including Agritrade International and NMC Health, have collapsed.

Masayoshi Son’s SoftBank Vision Fund injected $800m into Greensill Capital in May last year, and another $655m last October.