About 60 per cent of employers in the UAE plan to recruit additional staff in 2021 as an economic recovery and relaxation of Covid-19-related movement restrictions improve the hiring market outlook, according to a new report by recruitment company Hays.

The optimism is also reflected in the upbeat sentiment of the UAE workforce, with 62 per cent of UAE nationals and 56 per cent of expatriate workers feeling positive about their career prospects for the year ahead, said the Hays 2021 Emiratisation Salary & Employment report, which polled more than 100 UAE nationals in the fourth quarter of 2020.

“We have seen job numbers increase since the turn of 2021 and we expect this trend to continue going forward, with an added number of opportunities for UAE nationals in the private sector compared to previous years,” Samantha Wright, senior recruitment consultant with Hays’ Emiratisation division, said.

Border closures and movement restrictions during the Covid-19 pandemic affected the global jobs market in 2020, particularly in sectors such as aviation, events, hospitality and tourism, and caused many redundancies and pay cuts.

The Hays report found that 49 per cent of UAE employers were forced to reduce staffing budgets to remain operational in 2020. However, hiring activity has picked up since the fourth quarter as movement restrictions eased and companies were able to re-establish staffing budgets.

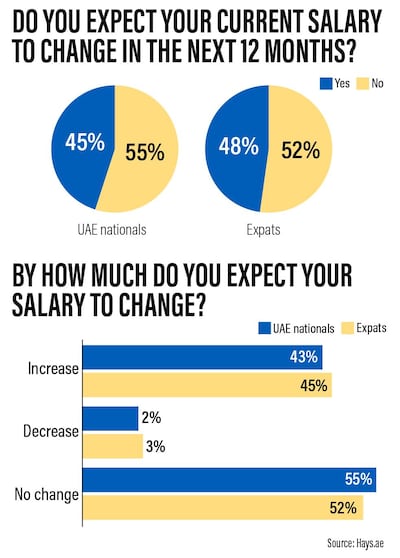

The salary expectations of Emirati and expat professionals are almost similar for 2021, with 55 per cent of UAE nationals expecting their salary to remain the same as it was in 2020 and 52 per cent of expats expecting salaries to remain stable. However, 43 per cent of Emirati workers expect their salary to increase and 2 per cent expect a decrease, while 45 per cent of expat workers expect a pay rise and 3 per cent expect a pay cut.

“We do not expect the pandemic to negatively affect salaries further in 2021,” Ms Wright said. “Instead, we expect the majority of salaries to remain the same in 2021 as in 2020, with increases being paid to those hitting required performance targets.”

Meanwhile, 64 per cent of Emiratis’ salaries remained the same in 2020 compared with 2019, 26 per cent received a pay rise while 10 per cent had their salaries cut, according to the Hays report. In comparison, 46 per cent of expat salaries remained the same last year, 33 per cent got a pay rise and 21 per cent had their salary cut.

The survey also found the number of Emiratis working in the UAE private sector is at a record high. Corporate services firms, banks, consultancies and investment firms within the private sector have increased the number of Emiratis they employ. However, “motivation to hire Emiratis is not purely based on government mandates”, the report said.

Public sector organisations in Abu Dhabi pay the highest salaries to UAE nationals – sometimes 40 per cent higher than private sector organisations, the report found. However, outside the capital, salaries within the public and private sector are shown to be either the same or up to 10 per cent higher in government entities.

Emiratis are now more open to the type of organisations they work for in an effort to be more competitive in the global talent pool, the report added.

“Historically, it was always government entities that provided the highest salaries to Emirati professionals, however, this is becoming less common,” Ms Wright said.

“As such, we have seen Emiratis be more open to working for non-government entities, considering employers based on long-term career development opportunities rather than just the salaries they offer.”

The Hays report also found that 49 per cent of UAE nationals and expat professionals expect to change jobs in 2021.

Emirati employees cited career development opportunities as the main factor when considering a new employer and said it was the main reason they moved jobs in 2020. Opportunity to progress within an organisation, the ability to see a clear career path to achieve future goals, an organisation's culture and flexible working are other reasons why employees moved jobs in 2020, according to the survey.

The most in-demand professionals in the UAE job market are IT specialists with digital technology and data-driven skill sets, the Hays report said. This is because of the ongoing digitalisation and automation initiatives across all sectors.

For all professions, employers are keen to hire employees with local market experience and who hold a degree and industry certification, the survey revealed.