Microsoft's fiscal third quarter net profit increased an annual 43.7 per cent on strong cloud, gaming and personal computing businesses as well as a net income-tax benefit.

Net profit surged to $15.5 billion in the three months to March 31. Revenue during the period soared 19 per cent to more than $41.7bn, exceeding the company's own guidance as well as the analysts' average estimate of $41.03bn. The company also registered a $620 million net income-tax benefit.

The January-March period marked the Redmond-headquartered company’s 15th straight quarter of double-digit revenue growth. The company's stock was down nearly 3 per cent in after hours trading. The share price has increased more than 50 per cent in the past year giving the company a market capitalisation of $1.98 trillion.

"Over a year into the pandemic, digital adoption curves aren’t slowing down … they are accelerating, and it is just the beginning," Satya Nadella, chief executive of Microsoft, said.

"We are building the cloud for the next decade, expanding our addressable market and innovating across every layer of the tech stack to help our customers be resilient and transform," he added.

Microsoft’s operating income grew 31 per cent to $17bn in the third quarter from the year-earlier period.

In its guidance for the fourth quarter, the company forecasts revenue in the range of $43.6bn to $44.5bn, which is higher than a $42.9bn consensus among analysts polled by Refinitiv.

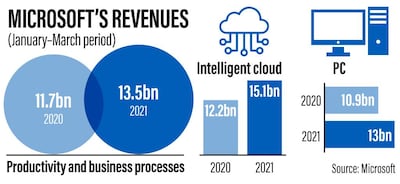

Sales in its PC business, which includes Xbox content, services and revenue from sales of its Surface device and search advertising, grew 19 per cent annually to $13bn.

PC sales have picked up as buyers upgrade their devices with the rise of remote working and home learning.

The industry braved a “significant ongoing constraints in the supply chain” but the global shortage of chips is causing availability constraints, Amy Hood, executive vice president and chief financial officer of Microsoft, said.

Revenues in the company’s intelligent cloud business increased 23 per cent year-on-year to $15.1bn.

“The Microsoft Cloud, with its end-to-end solutions, continues to provide compelling value to our customers," said Ms Hood.

The company’s productivity and business processes division, which includes both its Microsoft Office business and revenue from LinkedIn, increased 15 per cent to $13.6bn.

LinkedIn revenue grew by almost 25 per cent annually. Microsoft did not give a dollar figure for LinkedIn revenue and did not disclose the number of users.

The company returned $10bn to shareholders in the form of share repurchases and dividends in the third quarter, a yearly increase of 1 per cent.

It invested almost $5.2bn on research and development during the quarter, almost $317 million more than the same period last year.