Finance officials across the world held emergency talks yesterday in an effort to stem the fallout from the debt crises in both the US and Europe.

Financial Fallout: More on the global economic chaos

Region feels the effect of US ratings downgrade Concerns over the global economy pushed stocks down in the UAE and much of the Gulf. Read article

UAE likely to stick with dollar peg Regional pegs to the US dollar may come under the spotlight after the downgrade of the US credit rating by Standard & Poor's. read article

US downgrade threat to Gulf borrowing costs Banks in the Gulf may find themselves in a tough position following the downgrade of the US's credit rating by Standard and Poor's, analysts say. read article

Global gloom takes its toll on UAE stock markets Markets slumped in the Emirates amid a broad selloff of company stocks. Read article

From Friday's downgrading of the US credit rating by Standard & Poor's to how to stop Italy from becoming the next victim of the euro-zone sovereign debt troubles, officials had plenty to discuss.

Finance ministers from the G7 leading nations spoke by conference call, while European central bank governors were expected to hold emergency talks.

Officials are meeting ahead of the opening of Asian, European and US financial markets today. GCC stocks have already dipped in response to the US ratings cut.

"There may be choppiness in markets in the short term, although I expect the impact of the ratings cut to be limited in the longer term," said Nick Stadtmiller, a fixed income analyst at Emirates NBD.

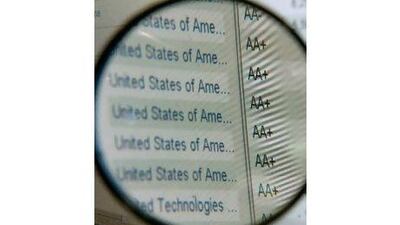

Ahead of S&P's action late on Friday, concerns about the outlook of both the US and European economies led to steep declines in global markets. S&P lowered the US long-term credit rating by one notch from "AAA" to "AA plus" in a move reflecting the weaker fiscal standing of the world's biggest economy. S&P warned the outlook was negative, an indication a further downgrade could happen in the next 12 to 18 months.

The move attracted criticism from the US Treasury department, which said it identified thousands of billions of dollars of errors in some figures used by the agency. The billionaire investor Warren Buffet also raised questions about the action.

Several global investors including central banks have signalled support to the US and the dollar since the downgrade. Yoshihiko Noda, Japan's finance minister, was expected to pledge at the G7 meeting to keep buying US treasuries, the country's Kyodo news agency reported yesterday.

Jordan had faith that the dollar and dollar debt would continue to be the prime benchmark for "risk-free debt", Faris Sharaf, the central bank governor of Jordan, told Bloomberg News.

In contrast, China on Saturday said Washington had itself to blame for the downgrade and called for a new global reserve currency. Across the Atlantic in the euro zone, tensions have also been ratcheted up. The European Central Bank (ECB) president Jean-Claude Trichet wanted officials at yesterday's meeting to make a final decision about whether to buy Italian debt, according to an ECB source quoted by Reuters.

If the decision is taken to intervene, the ECB and national central banks would start buying the bonds when markets open today, the source said. So far, the ECB has bought only small quantities of Irish and Portuguese bonds.

Silvio Berlusconi, Italy's prime minister, made an unscheduled appearance on Friday, promising further austerity and to balance Italy's budget in 2013. In recent weeks, the price Italy has to pay on its government bonds has risen sharply as concerns grow about whether it can service high debt levels against a backdrop of weak economic growth.

A second financial bailout of Greece just over two weeks ago was intended to help stop the debt crisis from spreading but has had little impact on soothing concerns elsewhere in the euro zone.