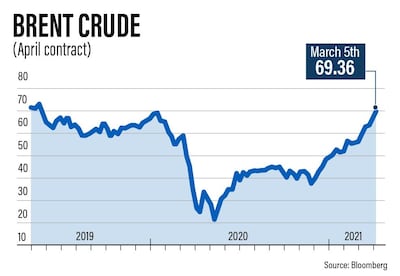

Oil prices rallied to their highest since 2019 on Friday after Opec and its allies agreed to extend existing production cuts to the end of April.

Brent, the benchmark under which two thirds of the world's crude is traded, ended the week at $69.36 a barrel.

West Texas Intermediate, which tracks US crude grades, closed at $66.09 per barrel. Both benchmarks are up more than 20 per cent over the past month.

The 23-member Opec+ group decided on Thursday to extend oil output restrictions of 7.2 million barrels per day but granted small exemptions to Russia and Kazakhstan.

Saudi Arabia, which leads the alliance alongside Russia, also decided to extend its outsize voluntary cut of 1 million bpd until the end of April.

The development was “a big surprise as market participants had expected an increase of 1.5 million bpd, with 500,000 bpd coming from Opec+ and 1 million bpd from Saudi Arabia, ending its voluntary 'one-off' cut for February and March”, said UBS commodity analyst Giovanni Staunovo.

UBS expects global oil stocks to fall at a faster pace in next month due to the decision, which underpins the Swiss bank’s forecast of Brent trading at $75 per barrel and WTI at $72 per barrel in the second half of the year.

Goldman Sachs expects Brent to reach $75 in the second quarter and climb to $80 in the third quarter. Citi forecast that oil will trade above $70 by the end of March.

Bank of America projected last month that Brent would rise at its fastest pace since the 1970s over the next three years, potentially hitting $100 a barrel.

Even before Opec+’s output cut extension, prices had rebounded on the back of a widespread vaccination drive in western economies, a strong drawback of crude stocks and an expected increase in higher demand for petrol and jet fuel.

The change in outlook is quite different from the market dynamics in April last year, when WTI futures contract prices slumped to minus $37 and Brent fell to $26 as a result of excess supply and lack of storage.

Although some analysts expect US shale oil production to improve as oil prices rise due to the output curbs, Saudi energy minister Prince Abdulaziz bin Salman brushed off a swift comeback by shale producers.

Speaking at the end of the bloc's meeting on Thursday, Prince Abdulaziz said the policy of "drill, baby, drill" was gone and would not return.

FXTM market analyst Han Tan said Opec+ was testing the resilience of the US shale industry, "betting that producers ... are no longer in a position to fully capitalise on the oil price recovery”.

Last year, Occidental Petroleum chief executive Vicki Hollub said that US output would never return to its pre-Covid levels when it hit a record 13 million bpd as the country overtook Saudi Arabia as the world’s largest producer.

“It is just going to be too difficult to replace the 2 million barrels a day of production that we have lost, and then to further grow beyond that,” Ms Hollub said at the Energy Intelligence Forum in October.

“Over the next three to four years, there is going to be moderate restoration of production, but not at high growth.”

Occidental is one of the biggest shale producers in the US.

The shale industry, whose growth was fuelled by debt, was hit hard by the coronavirus-induced slowdown.