Global sukuk issuance is set to bounce back in 2021 to as much as $151 billion as borrowers rush to sell Sharia-compliant bonds amid low interest rates, Mohamed Damak, the global head of Islamic finance at ratings agency S&P Global, said.

The economic recovery in Malaysia, Indonesia and the GCC – three core Islamic finance markets – and the ample liquidity provided by central banks around the world will drive growth in the market, he said in a report.

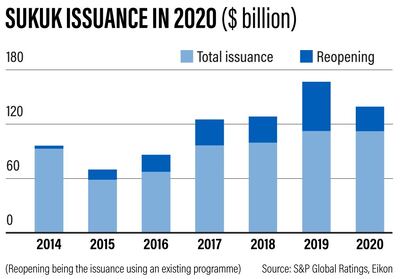

Total issuance in 2021 is forecast to be in the $140bn-$151bn range. At the lower end of estimate, the size of the market this year would be just above the $139.6bn total seen in 2020, but lower than the $167bn record witnessed in 2019.

“Market conditions should remain buoyant throughout 2021, with record-low interest rates and abundant liquidity,” Mr Damak said.

“We also expect GDP growth in the core Islamic finance countries … to recover from a sharp recession in 2020 [and] we assume that the price of oil will stabilise at about $50 per barrel in 2021. Together, these factors underpin a stronger performance by the global sukuk market in 2021.”

The ratings agency expects $65bn of sukuk to mature this year, with part of that sum likely to be refinanced, which will help to drive the volume of issuances.

While some sovereigns in core Islamic finance countries will tap the sukuk market more aggressively in 2021, the market will also benefit from the increased sale of corporate Islamic bonds.

“Their activity was muted in 2020 as they held on to cash and deferred capital expenditure because of the pandemic," Mr Damak said. “They [corporate sector issuers] are likely to execute some of this capex in 2021, thereby necessitating access to capital markets.”

First Abu Dhabi Bank, the UAE's biggest bank by assets, on Monday said it raised $500m through the lowest ever yield on a five-year dollar-denominated sukuk by a Middle East and North Africa bank. Pricing on the first dollar sukuk deal of the year represented a “negative new issue premium” when compared to FAB’s January 2025 maturity sukuk, the lender added.

Central banks around the world have rolled out monetary stimulus measures last year to support financial markets and limit the impact of the pandemic on their economies. Interest rates have been set near or below zero in many countries.

Lower interest rates are expected to remain in place this year and beyond, as the global economy continues to recover. The International Monetary Fund expects global GDP to expand 5.2 per cent in 2021 after contracting 4.4 per cent last year.

“We expect central banks will keep interest rates exceptionally low and continue to offer liquidity support as necessary,” Mr Damak said.

S&P estimate a sukuk market revival is based on the assumption that the pandemic will come under control gradually in the core countries from the second quarter of 2021, through a combination of vaccines, medical treatments and testing.

However, downside risks for the core Islamic finance countries remain significant, including their ability to control the pandemic even with the availability of vaccines.

“The main risk is that further waves of Covid-19 and the requisite containment measures may harm the countries' fragile economic recovery,” Mr Damak said. “This could affect the countries directly, or indirectly through lower commodity prices, exports and capital flows.”

S&P predicts the number of defaults or restructurings among sukuk issuers with low credit quality will increase in 2021 as “regulatory forbearance measures come to an end”.

“This will test the robustness of the legal documents used for sukuk issuances,” it warned.

Mr Damak expects a unified global legal and regulatory framework for Islamic finance market to emerge over the next 12 to18 months.

“We believe that such a framework could help resolve the lack of standardisation and harmonisation that the Islamic finance industry has faced for decades.”