Gulf airlines are bracing for possible disruption and need to be prepared for contingencies and financial losses as regional tension rises between the US and Iran.

Airlines in the region need to prepare contingency flight paths and brace for losses if rerouting or cancellations become necessary, analysts have said.

Iran on Thursday told airlines to avoid key Middle East fly zone amid sabre-rattling missile drills as it planned rocket launches across its south territory and part of the Gulf of Oman ahead of broader joint exercises with Russia and China in the Strait of Hormuz.

Potential US-led strikes on Iran could force airlines to avoid high-risk airspace, leading to higher fuel costs, stretched crew schedules and last-minute timetable changes, according to aviation experts.

Ernest Arvai, aviation analyst at US‑based AirInsight, said any escalation that triggers a broad no‑fly zone over Iran or neighbouring high‑risk areas would “push airlines on to longer routings”, particularly on long‑haul services that normally overfly the country. “However, for short flights, we don’t see a lot of disruption outside the direct danger areas,” he tells The National.

Operational strain

Detours of two to three hours on wide‑body aircraft could add about $6,000 to $7,500 per flight hour in operating costs, Mr Arvai warns, a move that can significantly increasing the bill for each sector that has to skirt closed airspace.

“Losses will be dependent on the type of aircraft and its cost structure,” he said, adding that financial losses for airlines come from two sources: “the loss of revenue from flight cancellations or delays, and from higher operating costs for additional time, fuel, crews and lower load factors, if passengers prefer to avoid the region during a conflict”.

Airlines will keep a close eye on booking levels and keep in contact with regulatory and government authorities for the best advice on security of operation, said John Strickland, a UK-based aviation analyst and director of JLS Consulting.

“In recent weeks, airlines have introduced longer routings to avoid affected areas,” he says. “These, of course, lead to timetable disruptions and add to costs.”

The Gulf’s position at the nexus of Europe‑Asia traffic means any Iranian airspace closure or wider conflict would impact the whole region.

On Thursday, the notice-to-airmen (Notam) was issued amid heightened tension. The system provides pilots, flight crews and other airspace users with critical safety notices. Airlines have been avoiding the area for some time, and it is not clear if the Iranian-led drills will affect Middle East carriers.

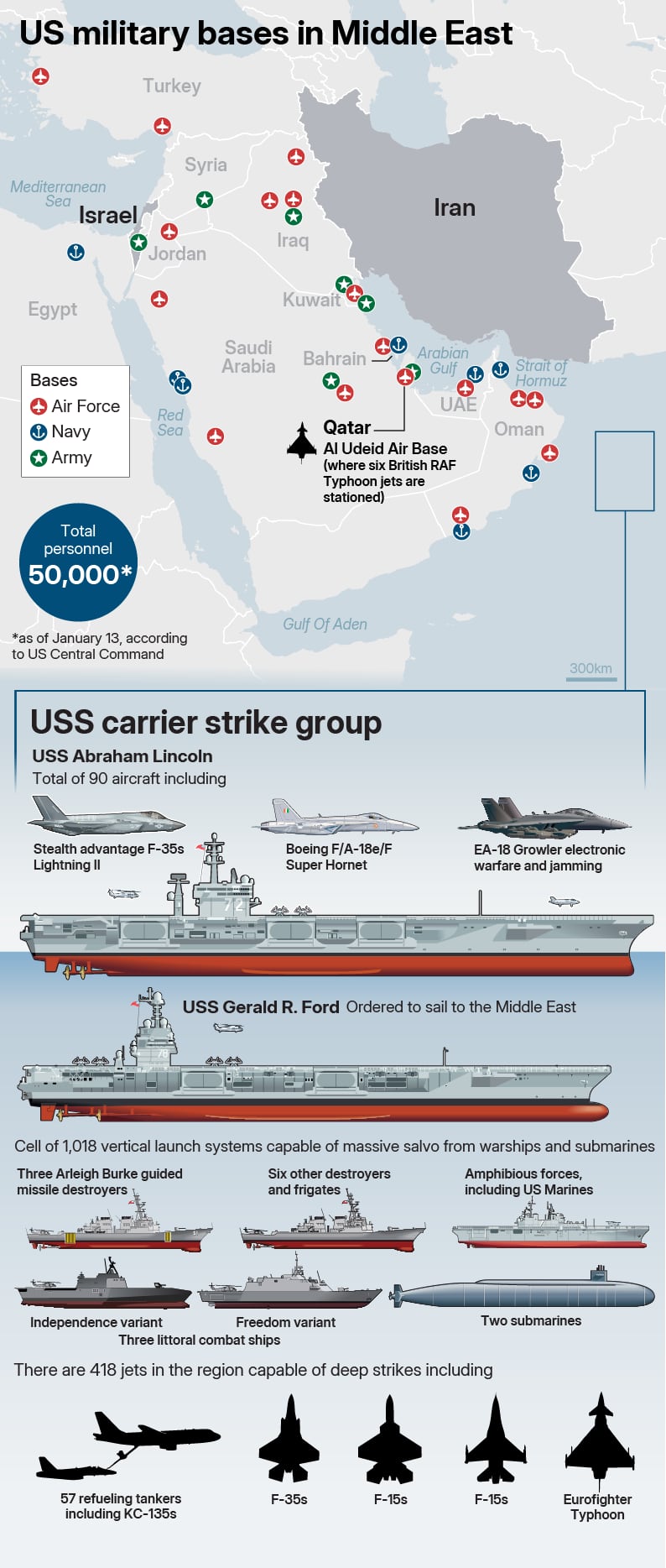

The US has deployed two aircraft carrier strike groups to provide firepower and air capabilities for a sustained military campaign against Iran, and publicly available flight tracking information showed a steady stream of American warplanes heading to the region this week.

Iran held exercises in the Strait of Hormuz this week and on Wednesday announced it would hold naval drills with Russia to “enhance security and sustainable maritime interactions in the Sea of Oman and the northern Indian Ocean”, Iran’s Fars news agency reported, quoting an Iranian navy commander.

US President Donald Trump on Thursday gave Tehran a new deadline to reach a deal over its nuclear programme. He said the world would find out within 10 days whether the US is going to take military action against Iran. On Friday he hinted at action sooner, saying he is "considering" a limited strike.

Prepared but cautious

“The region’s airlines are, unfortunately, experienced in this regard from the wars in Kuwait, Iraq, Afghanistan, Lebanon, Israel, and other wars,” added Mr Arvai. “They will just need to be nimble, ready for rapid schedule changes, adapt to flight cancellations in areas under attack and avoid transiting those areas for flights beyond, extending fight times and schedules.”

Saj Ahmed, chief analyst for London-based Strategic Aero Research, believes the impact of the airspace closure will be “limited”, as airlines across the Gulf region had been on high alert already since the brief but intense Iran-Israel conflict in June last year.

“Many airlines were already avoiding Iranian airspace out of abundance of caution,” he said. “Carriers already have preventive safety route planning in play, so that should minimise any disruption on the back of Thursday’s Notam, which in itself is a limited restriction.”

He believes any financial impact as a result of these changes will be “minimal”.