The fallout of the Covid-19 pandemic has spurred many consumer trends and will define businesses’ response to them in a world with rapidly changing dynamics, a report by Euromonitor found.

Change was the only constant over the past two years, with radical lifestyle shifts motivating consumers to make “intentional, mindful and ambitious decisions”, the London-based market research firm said.

“Now, the world is on the road to recovery. Consumers are putting their plans into motion, taking chances and seizing the moment,” Euromonitor said.

The 10 trends below indicate ways consumers are taking back the reins and paving a path forward based on their passions and values:

Back-up planners

Back-up planners, who are faced with challenges in securing their usual or desired products, are looking for ways to purchase similar items or finding creative solutions to obtain similar items.

More importantly, they use technology to move to the front of the queue when supplies are threatened.

Climate changers

Eco-anxiety is making consumers aware of their individual contribution to climate change, driving purchasing decisions.

In 2021, 43 per cent of professionals said the lack of consumer willingness to pay more for these products is a significant barrier, hindering business sustainability initiatives.

Digital seniors

With the pandemic forcing the world into using digital channels, older adults have caught in on the trend: 82 per cent of consumers aged 60 and above owned a smartphone in 2021.

More than 65 per cent of this age group – which has high spending power – are seeking simpler lives, so businesses need to cater to this group.

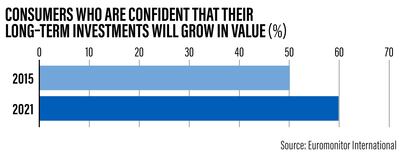

Financial aficionados

Greater savings and time at home, hand in hand with fewer opportunities to spend money, drove consumers to improve their financial position.

The study said 51 per cent of consumers believe they will be better off financially in the next five years.

Great life refresh

Covid-19 triggered consumers to make drastic personal lifestyle changes. Businesses, then, should innovate their marketing and services that cater to this “once-in-a-generation moment”.

Employees have higher expectations from their employers when it comes to their well-being, with 44 per cent of professionals thinking their companies will invest in employee health and welfare.

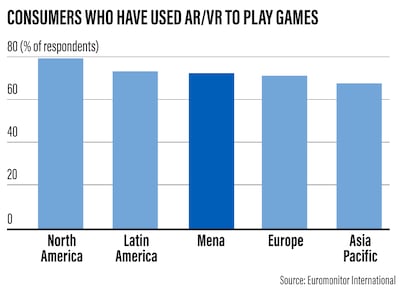

Metaverse moment

The metaverse, the new digital playground further blurring the boundaries of the real and virtual worlds, is driving social networks to advance their capabilities to enter what Euromonitor says is the “Metaverse Movement”.

Arguably, all sectors will try to leverage the metaverse. The study showed that global sales of augmented and virtual reality headsets grew 56 per cent from 2017 to 2021.

Pursuit of pre-loved

Thrifting is trending, with the survey saying 33 per cent of consumers buy used or second-hand items at least every few months.

While consumers want to live sustainably, they have also made affordability a crucial factor during the unstable economic situation.

Rural urbanities

Suburban and rural communities, which offer more spacious housing and greener scenery, are luring consumers out of metropolitan areas – especially with 37 per cent of consumers expecting to work from home in the future. Conversely, city dwellers also want these benefits brought into their neighbourhoods.

Added key factor: scaling e-commerce distribution will be vital by establishing of micro-fulfilment centres and increasing last-mile deliveries.

Self-love seekers

Acceptance, self-care and inclusion are at the forefront of consumer lifestyles today.

About 56 per cent of consumers believe they will be happier in the next five years, while 54 per cent of professionals believe that more personalised shopping experiences will have a strong impact on retail over the next five years.

Socialisation paradox

The pandemic triggered a change in the ways people socialise, and this will continue in 2022, but this paradox shows that consumers are gradually returning to their normal lives.

About 76 per cent of consumers took health and safety precautions when leaving their homes in 2021 and 51 per cent expect their lives to be better in the next five years.