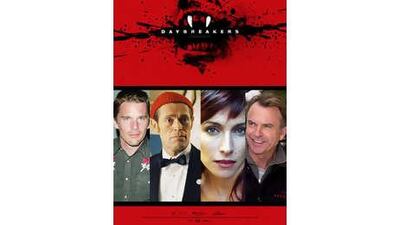

So if everyone who gets bitten by a vampire turns into a vampire and vampires bite people every time they get hungry, that ought to mean that the supply of non-vampires dries up pretty quickly, right? Screenwriters call this kind of niggling "fridge logic", because it resembles the thought-processes involved in trying to work out whether the light stays on when you close the fridge door. It is also the plot of Daybreakers, a vampire film from Australia's Spierig brothers, which is a little fresher, if not more chilling, than some of the leftovers viewers have been served in recent years. It's 2019 and Ethan Hawke is a vampire haematologist searching for a blood substitute to end the famine that is sweeping the fanged population of the planet. Instead he finds Willem Dafoe, who seems to have found a cure for vampirism itself. The stage is set for a brisk, none-too-serious parable about sustainability and the corrupting influence of vested interests, enlivened by gallons and gallons of gore. Sam Neill stands out as Hawke's blood-sucking boss, a plump Dracula with a corner office, and Hawke broods serviceably throughout. Much fun is had with the idea of an all-vampire polity, drinking vampire coffee and riding the subway to their vampire jobs. Meanwhile the mythos gets a nice new wrinkle with the idea of "subsiders", abject, Nosferatu-like creatures to which vampires are reduced by starvation. Alas, the third act doesn't quite make good on the promise of these innovations. But perhaps its inconsistencies will cause a lightbulb to come on for someone else. When one door closes...

DVD review: Daybreakers

A vampire film that is a little fresher, if not more chilling, than some of the leftovers served up in recent years.

Most popular today