Much-loved musical West Side Story will set hearts alight with a Valentine's run at the Dubai Opera.

Leonard Bernstein’s highly hummable score will ring out across the new 2000-capacity venue in Downtown Dubai, over five nights next year, from February 14-18.

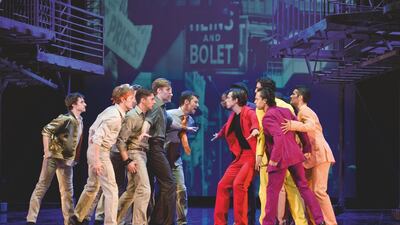

Based on a book by Hitchcock collaborator Arthur Laurents and inspired by Shakespeare's Romeo and Juliet, the timeless plot plays out the trials of two young lovers against the backdrop of rival New York gangs.

The original 1957 production marked the Broadway debut of legendary lyricist Stephen Sondheim — the winner of more Tony Awards than anyone — while Bernstein’s score gave birth to many familiar melodies, including Something’s Coming, Maria, I Feel Pretty, America and Gee, Officer Krupke.

Their work was later celebrated in the classic 1961 screen adaptation, starring Natalie Wood and Richard Beymer.

Broadway veteran Joey McKneely helms the production heading to Dubai, which will recreate Jerome Robbins’ original choreography with a cast of 36 performers, from a total of 80 cast and crew members.

Jasper Hope, chief executive at Dubai Opera, said: “It’s fantastic to be able to bring this incredible production for the first time ever to the GCC, and to introduce this timeless classic to an entirely new audience”.

Tickets for the run at Dubai Opera are on sale now. See dubaiopera.com.

rgarratt@thenational.ae