Michael Jackson The Immortal, a tribute to the late King of Pop and Cirque du Soleil's largest grossing theatrical production, will be the highlight event of this year's Dubai Shopping Festival.

The world tour that has been attended by millions of Michael Jackson fans in 24 countries around the world making over US$340 million (Dh1.25bn) since it first premiered in 2011 will be in Dubai for 16 days from December 30 to January 14.

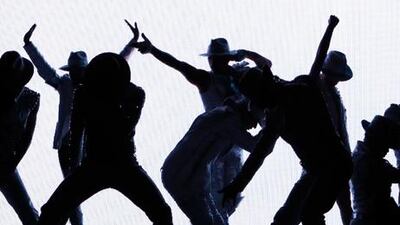

Conceptualised and directed by Jamie King, who toured with the star on his Dangerous World Tour, the show marries the adrenalin pumping numbers and routines of the man once known as the world’s greatest entertainer with the trademark theatrics and acrobatics of Cirque du Soleil, the Quebec-based production house.

“How can you not create a large show when you mix the world of Cirque du Soleil and that of Michael’s, who was a maverick in his field,” said King at yesterday’s press conference announcing the show, organised for the festival by Duvent, an arm of Meraas Leisure and Entertainment. “It is not only a rock-style show but a theatrical show. We literally go into Michael’s head and feel and see the essence that is Michael.”

More than 60 artists, acrobats, dances and musicians will depict the larger than life interpretation of the ideologies followed by the star, who died a few weeks before his biggest sold out performance This is It in 2009."This is kind of our way of saying goodbye," said King. "Michael was a showman and in the show you will experience some of that. We interpret it in a certain way. The music is larger than life, the dance and acrobatics are larger than life."

Renee-Claude Menard, the senior director of public relations at Cirque du Soleil, said this is the most ambitious project the group has ever attempted. “Michael was one of our biggest fans and wanted to work with us for a long time,” she said. “When he passed, we were so driven that we had to do this for him.”

The show will recreate about 35 of the artist's most popular songs, together with a mix of mash-ups and original tunes. "You will hear some pieces like Keep it in the Closet mixed into Dangerous," said King. "We creatively went down new roads with this.

”The finale will be to the backdrop of the Neverland Ranch with performers bringing their best for one of his biggest hits Black or White. Organisers said they were expecting more than 6,000 spectators for each show during the 16-day stop in Dubai. Fox said it is fitting to bring the show to the UAE. “I look at the huge buildings and the man-made islands and think, this looks illogical and this is Michael Jackson. He believe in what, at first, seems illogical.”

* Tickets for the show can be purchased on www.ticketmaster.ae and start at Dh295. Visit www.duvent.com