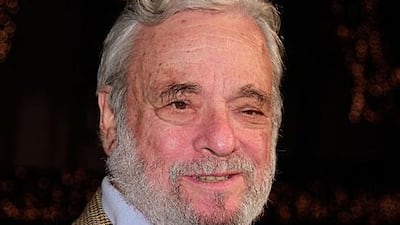

"'Obama' has a lot of good rhymes," Stephen Sondheim tantalisingly told a packed audience at London's Royal Festival Hall last weekend. The legendary Broadway lyricist and composer has written only one show in the past 15 years, but during a discussion of "Bobby and Jackie and Jack", a song he wrote about the Kennedys in 1961, he suggested he might like to have a go at penning something about the new family in the White House.

At the moment, though, it's the past that's occupying Sondheim. Having celebrated his 80th birthday this year, with various star-studded concerts featuring the likes of Judi Dench and Catherine Zeta-Jones, he's just released a hefty book of his collected lyrics with, in his words, "attendant comments, principles, heresies, grudges, whines and anecdotes." Entitled Finishing the Hat (after a song about the artistic process from Sunday in the Park with George), it's the first of two volumes, spanning the period from the penning of Sondheim's first musical in 1954 to his 12th, Merrily We Roll Along, in 1981.

The book is both detailed and fearless. Alongside all the lyrics from musicals such as Sweeney Todd and A Little Night Music are painstaking notes on why each line works or fails. We can read Sondheim's first couple of stabs at an opening number for West Side Story before he settled on Jet Song, and see him berating himself over lines like "say it soft and it's almost like praying" from the ballad Maria.

"The line made little sense and merely contributed an overall wetness to the lyric," he writes, "a wetness, I regret to say, which persists throughout all the romantic lyrics in the show."

Sondheim doesn't confine his criticism to his own work, either. Instead, he deconstructs the output of pretty much every great lyricist of the century, with one caveat: they must no longer be living. At the Festival Hall talk, he neatly summed up the reasons for speaking ill only of the dead: "You can't hurt their feelings, and they can't argue with you."

So Noël Coward is "brittle and sentimental", Lorenz Hart is "sloppy", and Ira Gershwin's "technique isn't good enough to hide the strenuousness of his [wordplay]". Special ire is reserved for WS Gilbert, whose work is damned as tedious, bloodless, quaint and predictable. Even Oscar Hammerstein, Sondheim's great mentor, is taken to task. He's accused of redundancy ("Brisk, lively, merry and bright? And Allegro? Sounds like a thesaurus entry") and of having a "need to spell things out with plodding insistence".

As anyone who knows the story of Sondheim's rise to fame is aware, however, his respect for Hammerstein far outweighs his criticism. The story of the older writer mentoring a teenage Sondheim has become the stuff of musical theatre legend, and Sondheim talked the London audience through the experience fondly. "That was the afternoon of my life," he said, about the day Hammerstein sat down with a copy of Sondheim's play By George, written at age 15, and criticised it line by line. "In four or five hours he taught me everything he knew about theatre and writing lyrics," Sondheim said. "He treated me like an adult; that was what was wonderful. I can remember everything he said ever since."

Not all of us are lucky enough to live next door to a genius, but Finishing the Hat can be seen as a way to pass on this seminal lesson to the next generation of musical theatre writers. The book emphasises four golden rules of lyric writing: content dictates form, less is more, the details are everything, and (above all else) that everything is in the service of clarity. "A lyric exists in time and unlike poetry you can't go over it at your own leisure," he said in London. "If an audience don't like what they hear, fine, but if they don't understand what they hear, then the author has committed a sin."

Sondheim's attention to detail has served him well. His work may not be as well known as Cats or Phantom of the Opera, but among his fans he's a legend. Over the years he's won an Oscar, eight Tonys, eight Grammys and a Pulitzer Prize, and his biggest hit, Send in the Clowns from A Little Night Music, has been recorded by Frank Sinatra, Grace Jones and Barbra Streisand.

March 22 was the date of the lyricist's 80th birthday, but in London the celebrations are still ongoing. A production of his 1994 show Passion, about requited and unrequited love, opened at the Donmar Warehouse in September and will run until November 27, and over the next few weeks there will be concert performances of Merrily We Roll Along and Company at the same venue. Meanwhile, American fans will be able to watch the New York Philharmonic's Sondheim: The Birthday Concert on the PBS network late next month.

In Sondheim's account of the history of musicals, Hammerstein changed everything in 1943 with Oklahoma! which, in his eyes, introduced the masses to the idea that a musical could have sustained characters, a sophisticated plot, and lyrics that reflected both, rather than being mere flights of fancy. So what are his predictions for the future? "Musicals are going in many different directions, and many of them are dead ends, I think," he told the Festival Hall audience with characteristic bluntness.

He expressed disdain for two current trends: the "jukebox musical", which relies on the hit songs of a pop band to draw in punters; and what he calls the "meta-musical". The former are lucrative, because they already have a fan base who know exactly what to expect; in Sondheim's words they come in "humming the hit tunes [of the show] as they go into the theatre instead of coming out of it". The latter group, musicals about making a musical, are doomed to a short lifespan in Sondheim's opinion "because it's a gimmick that wears its welcome out fairly quickly".

With some luck, Finishing the Hat will be read by some talented 15-year-old who'll soak up its wisdom in the same way that a young Sondheim took in the words of Hammerstein at his peak, and put musicals back on a more inventive track. If not, we'll have to hope Sondheim himself comes out of semi-retirement and writes that ode to Barack and Michelle.

Finishing the Hat

by Stephen Sondheim

Knopf

Dh99