London galleries are banding together for the first London Gallery Weekend, set to run from Friday, June 4 to Sunday, June 6. Organised into three days, 139 of the city's commercial institutions will open new exhibitions and host (socially distanced) tours to get the city's public to re-engage with art.

“First and foremost we want this to be a celebration of the diversity of London's gallery landscape,” says Jeremy Epstein, co-founder of the Fitzrovia gallery Edel Assanti and the driver behind the initiative.

“London is hard to parallel when you look through our list of participants. Even if you consider yourself very familiar with London's gallery landscape, there are many new faces that have emerged in the past couple of years, which are running really ambitious programmes.

"It’s not just the case that those spaces are seeking affiliation with larger spaces – it's also the case that more established galleries want to nurture the approach that you get in those smaller spaces.”

The idea for the event came after Frieze last November. Because the art fair was held in a socially distant format, no tent went up in Regent’s Park and instead the bulk of the art-viewing took place in its galleries, which had opened their doors in timed slots.

At the end of the week, many gallerists wondered why they needed a fair to bring punters to their doors. If anything, visits to galleries are low priority during Frieze week.

That's when London galleries decided to take things into their own hands.

The weekend is bracketed off geographically, with a Friday afternoon spent among Central London’s more genteel, better-heeled galleries; a Saturday in South London, which has the youngest and most newly ambitious spaces; and finally, an easy Sunday in East London, with its gentrified coffee shops around every corner.

Galleries are hosting special events, tours for children and walk-throughs by the artists. Because of coronavirus restrictions, offerings tend toward the more socially distant than the parties or dinners one might expect. One planned event is a podcast with Financial Times' arts editor, Jan Dalley.

Partners such as Claridge's will serve complimentary coffee and pastries, and a handful of London directors and curators, such as Sarah McCrory of the Goldsmiths CCA and Martin Clark of Camden Art Centre, are suggesting curated routes.

Gallery weekends are regular events, though London has never had one before.

“I've always felt that London lacked a sense of community in way that you see with our European neighbours,” says Epstein. “London galleries are used to participating in the fair circuit and having a fleeting audience that they meet up with in many different places around the world.

"But now all of those people have had a year in which they've had to revisit their business practices, and the fundamental thing that happened in London, which is comparable to many places, is that people want to invest in their own city.”

Epstein and Goodman Gallery’s Jo Stella-Sawicka crafted an anonymous survey that they put out to gallerists after Frieze week, and the results were (nearly) unanimous.

There was also broad agreement on the parameters of the event: it should be peer-led, and everyone was willing to pitch in – a sentiment many are heralding as a new spirit of collegiality for the city.

In the coming years, the weekend will be oriented towards international collectors, and the event is positioned strategically in the calendar to be right before Art Basel.

London, the gallerists hope, will be a gateway for Americans coming over to Europe, and the timing also coincides with other established art events such as the Serpentine Summer Party and the Royal Academy summer exhibition.

But this year, the focus will be on the London public. Some are showing hometown faces – Gagosian nods to the Young British Artist movement of the late 1990s, with an exhibition of Damien Hirst and Rachel Whiteread, and Hollybush Gardens will show works by Claire Hooper, who has long lived in London, and Palestinian artist Jumana Manna.

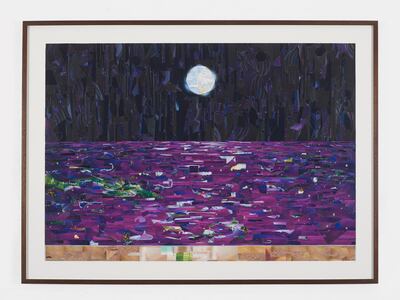

Other highlights include the raucous, perspicacious works of Algerian photographer Mohamed Bourouissa, at Goldsmiths CCA, and John Akomfrah's sublime Four Nocturnes (2019), a video knitting together the destruction of the natural world, the slave trade in Africa and nature documentaries, at the Lisson.

Restrictions vary among galleries so visitors should check before arriving, and ride-sharing bike service Lime is offering free rides for gallery goers