Welcome to The National's weekly newsletter Beshara, where we share the most positive stories of the week.

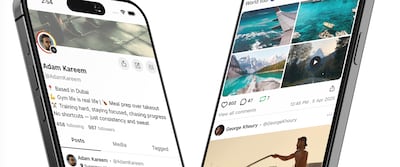

There's a new app in town – and this one's definitely worth the download.

As a former social media journalist, I know all too well the frustration of having content “shadow banned” when you’re simply reporting the truth.

Coverage from Gaza during Israel's two-year war on the enclave was sometimes met with resistance from social media platforms that have millions of users. Posts on my personal, private account received even less exposure, with a drastic drop in views compared with almost any other story I shared. And I wasn’t alone. Friends, family and colleagues noticed the same pattern.

A form of digital censorship on platforms built to enable a wider reach? The irony wasn’t lost on us.

That’s why UpScrolled was created. And it’s why it’s gaining traction so quickly.

Founded by Palestinian-Australian tech entrepreneur Issam Hijazi, the app has reached the number one spot on the US Apple App Store and is currently the second most downloaded app on iOS, narrowly behind OpenAI’s ChatGPT.

The team behind UpScrolled says the platform “began as a response to the silencing of Palestinians". Last week, it crossed the one million user mark.

Can the app maintain this momentum? Only time will tell. But for now, it’s a welcome addition to a digital sphere where misinformation runs rampant and truth is too often silenced.

Do you have a Beshara you'd like to share with us? You can reach me at FAlMahmoud@thenationalnews.com.

Reopening Rafah

Israel said on Sunday that it had reopened the Rafah crossing between Gaza and Egypt "in a limited capacity", with only people leaving or returning to the enclave to be allowed to pass from Monday.

Reopening the crossing for aid "without interference" was a requirement under the first phase of US President Donald Trump's ceasefire plan and remains an unfulfilled element of the deal.

However, the partial reopening of the border can help enable the medical evacuation of about 20,000 people in Gaza. On the other side, 22,000 Palestinians living in Egypt are waiting to go back home.

While a fragile ceasefire has brought little respite to Gaza's residents, hopefully, the reopening of Rafah can make way for life-saving aid to finally enter the strip.

Quoted

'People ask me, ‘You sit in a wheelchair, why do you play badminton?’ I say, 'Because I can''

- Jamal Al Bedwawi, 37, is making history as one of the world's top athletes in para badminton. Ranked No 18, he wants to change perceptions while playing a game he loves.

An unexpected attraction

Mimi is one of half a dozen stray dogs that have in recent weeks made Cairo's Grand Egyptian Museum their unlikely home, sharing the space with King Tutankhamun's treasures and majestic statues.

Their presence has added another attraction to the thousands of ancient Egyptian artefacts that fill the galleries of the $1 billion museum, which is now one of the country's hottest tourist sites.

The dogs living at the museum have been met with kindness and care by visitors and staff, which speaks to a refreshing change of attitude in a nation with a large population of stray dogs and a history of animal abuse.

Snapshot

See Beshara photos of the week here

Impact on Instagram

Follow @TheNationalImpact on Instagram for more good news.

Highlights

The National produces a variety of newsletters across an array of subjects. You can sign up here.