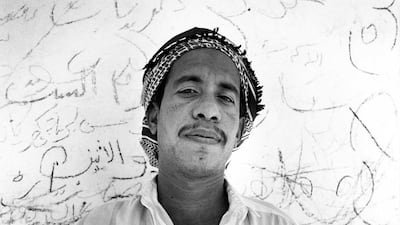

Ramadan in Yemen documents the travels of Australian photographer Max Pam through this amazing country in the late 1990s; a period marked by Yemen’s first national election. Working exclusively in black and white Pam explored the country, translating his experiences into a series of images and diary entries, which reflects the artist’s distinctive style involving a layering of his experiences though words and images.

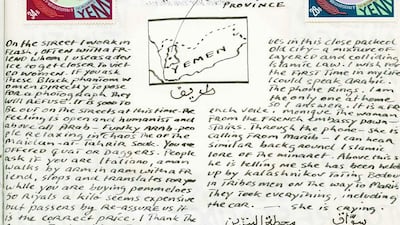

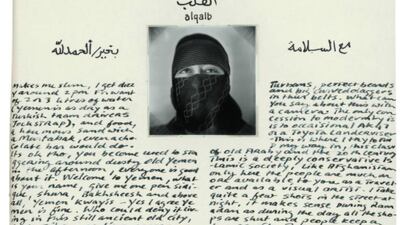

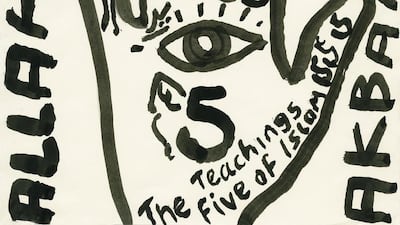

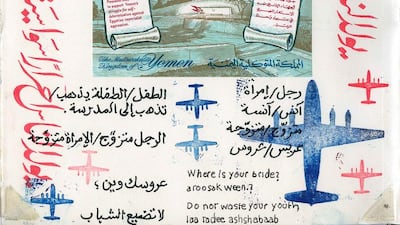

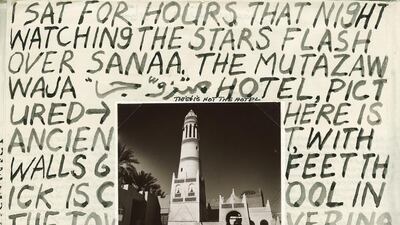

Max Pam travelled across the country, sharing in the everyday lives of its people from the capital, Sanaa, to Shibam, Taizz, and Al Mukallah; then through the desert, along the country’s coastline and up into its mountain regions. By combining his black and white documentary photographs with handwritten journal entries, annotations, notes, other visual marks and ephemera, Pam presents an intimate journal of his life. These additional layers help transport the viewer back to a very specific moment in time, while giving in-depth insight into his creative processes; “…Because a lot of things you can’t photograph, but you can draw and write about and they are important to me, those other ways of defining experience.”

Max Pam is recognised around the world for his visual travel explorations. Born in 1949, he grew up in post war, suburban Melbourne, which he has described as ‘a culturally isolated, dull environment’. He found his escape through the counter culture of surfing and imagery in National Geographic and Surfer magazines, which planted the wanderlust that would later fuel his future artistic vision.

Leaving Australia at the age of 20, Pam worked as a photographer assisting an astrophysicist; together they drove from Calcutta to London in the early 1970s. From that time until now, his in-depth, personal travel experiences have shaped his artistic work.

Pam is a storyteller par excellence, he says of his continuing travels; “I want to continue to tell a story, to explore conventions and turn them on their head.” His carnets de voyage takes a fresh look at countries through his very distinct vision. Every picture is a gift; an insightful vision, the unfolding random events, reveal both the artist and the land he is discovering to his audience. Pam describes the act of photographing as “ … a totally beautiful invitation to jump headlong into something unknown and inviting ...” his work reveals the mutual curiosity and exotic nature experienced by both photographer and subject to each other.

Pam has also published a number of his photographs and journals, as he finds a book format the best way to translate his experience and vision; “I always ask myself how can I turn this experience into something meaningful and its always a book format that presents itself as the way to translate that experience and that visual language … If you open a book that I’ve done, you go into my experience rather than some generic editorial work that is highly competent, but is not representative of anywhere other than … another country extolling exotica.”

He says about Ramadan in Yemin; “What could I say about Yemen that did it justice. I tried in my journals to work it honestly … that hot, spare and beautiful Ramadan … The faithful waiting for the moment. The cannon booms from the mosque in the afterglow of the day. KABOOMMMM and the frenzy of tea drinking and food eating begins at the souqs and squares and oases and towns all over the country. Everyone happy, elated, laughing and joking, sitting down together as one nation … People always wanted me to share and be a part of their Ramadan, their community, their Yemen … That unforgettable Ramadan month. An experience freely given to me by the generosity of the Yemeni people.”

The exhibition will be on display at the East Wing gallery in DIFC and runs from 15 July until 10 September. Gallery hours: Saturday through Thursday 10am — 10pm and Friday 4pm to 10pm.