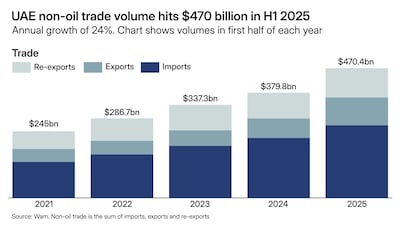

The UAE's non-oil foreign trade rose by nearly a quarter on an annual basis in the first six months of 2025, bucking the global trend as the Emirates continues to diversify its economy and forge trade international partnerships.

The value of non-oil foreign trade for the January-June period jumped to more than Dh1.73 trillion ($470 billion), double the level of five years ago. In comparison, the average growth of global trade during the first half of this year was about 1.75 per cent.

The UAE’s foreign trade was worth Dh5.23 trillion ($1.4 billion) last year, a 49 per cent rise from the levels achieved in 2021.

One important driver of the UAE’s flourishing non-oil trade is the country’s economic relationships with an expanding list of partner states.

The country has signed 28 Comprehensive Economic Partnership Agreements (Cepa). This is opening new markets, boosting trade and investment flows, and removing tariffs.

Abu Dhabi’s non-oil foreign trade also jumped 34.7 per cent annually to Dh195.4 billion ($53.2 billion) in the first half of this year amid the emirate’s diversification efforts. The emirate's exports, imports and re-exports rose from January to the end of June, Abu Dhabi Customs said.