The Iraqi army on Sunday said air defences shot down two drones over the Iraqi-US base at Al Asad in the country's western desert.

The intercepted mission was the second acknowledged drone attack on Al Asad this year.

The tactic of using drones against US forces could be part of a strategy by Iran's Islamic Revolutionary Guard Corps (IRGC) and their Quds Force, which specialises in unconventional warfare, co-ordinating with Iraqi groups.

According to a May 21 Reuters report, the new strategy involves creating groups in Iraq that operate independently from Iran's high profile allies, such as Iraqi militia group Kataib Hezbollah.

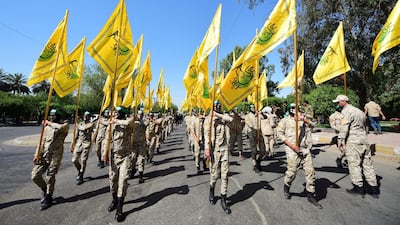

Kataib Hezbollah and another leading group, Asaib Ahl Al Haq, were formally integrated into the Iraqi security forces in 2014, part of a force called the Popular Mobilisation Forces (PMF).

But after fighting ISIS, these groups reverted to attacking US forces and murdering their political opponents in Iraq.

Other PMF groups linked to Iraq's Shiite clergy in Najaf and Karbala remain close to the Iraqi government and have not attacked the US.

The Iran-backed PMF groups have now become a thorn in the side of the Iraqi government, which wants to continue working with the US.

In the line of fire

The rationale for creating groups, Reuters claimed, was that the activities of Iran-backed PMF groups were attracting unwanted attention both politically and from a security perspective.

PMF attacks on US forces had led to lethal US air strikes, placing Iranian advisers at risk, including Iranian General Qassem Suleimani who was killed in a US drone strike on January 3 last year.

After his death, the report claimed, Iran no longer trusted PMF groups.

Could Iran be jettisoning its old allies, and are the new groups behind the drone attacks?

A new approach

Analysts and Iraqis close to the matter tell The National that any split between Iran and the PMF is unlikely.

They say that new groups or front groups are merely attempts to sow confusion as to who is responsible for attacks.

“What’s happening now is not disengagement with Quds Forces or Iran in general as some see, but instead further cementing the alliance,” said one Iraqi MP affiliated to the Iran-aligned Fatah political bloc.

“Things have changed a bit after the martyrdom of the leader Qassem Suleimani. Now, we have ample space to discuss policies and plans and the brothers in Iran understand this and they are listening to us. Forcing the US troops out of Iraq is a goal we share,” he said.

“Our work and presence are not only limited to Iraq as we are in Syria for example now and can be in Yemen or Lebanon or anywhere if needed,” he said.

Bringing back Hezbollah

Increasingly, Iran is contracting out militia training operations to Lebanese Hezbollah – another claim in the Reuters report.

Hezbollah could also have played some role in the drone attacks.

“At least 250 fighters travelled to Lebanon over several months in 2020, where advisors from Iran's IRGC and Lebanon's Hezbollah trained them to fly drones” the report said.

But this co-operation is not new.

In January 2007, Asaib Ahl Al Haq members disguised as US forces infiltrated a US army facility in Iraq, killing five soldiers.

Ali Musa Daqduq, a senior member of Hezbollah’s special operations forces, played a key role advising on the raid.

Daqduq had formed a co-ordination centre with the IRGC for this purpose in May 2006, according to analyst Kimberly Kagan.

Daqduq was captured by US forces in 2007, along with the head of Asaib Ahl Al Haq, Qais Al Khazali, but was later released after being transferred to Iraqi custody.

"Quds Force likes to protect its people, so using Lebanese Hezbollah reduces exposure," said Michael Knights, an analyst at the Washington Institute for Near East Policy.

"Lebanese Hezbollah has a big role in Iraqi business now, alongside Shibl Al Zaydi."

They may have an advisory assist on drones and "they definitely do on media operations", he said.

Al Zaydi is one of Hezbollah's key allies in Iraq, along with Muhammad Kawtharani, a political go-between for Lebanese Hezbollah and Iraqi groups who is now wanted by the US.

The US imposed sanctions on Al Zaydi, who formed a drone company called Gulf Bird in 2007 with Hezbollah-affiliated businessman Samir Berro.

Hezbollah were already conducting drone operations, having flown an Iran-designed Mirsad-1 drone into Israel in 2005, before it was intercepted by Israeli jets.

“Hezbollah, while having a small role helping Iran-backed Iraqi groups prior to 2011, massively increased their role in Iraq during the war on ISIS,” said Hamdi Malik, an analyst with the Washington Institute.

“This happened after Hassan Nasrallah said it was imperative to send Hezbollah advisers to the PMF in 2014,” he said.

At the time, Hezbollah was using Karrar suicide drones against ISIS in Syria. In Iraq, radical PMF groups such as Kataib Hezbollah were flying Yasir drones, reverse-engineered from the US-made ScanEagle drone, against the extremist group.

Hezbollah could therefore have played some role in the current Iraqi attacks, perhaps co-ordinating with front groups for Kataib Hezbollah, who Mr Knights says play a key role in PMF drone operations.

Regional diplomacy

According to one Iraqi intelligence official, Iran is using secret new groups to keep up pressure on the US while exploring talks with regional powers.

“Iran is in a new era of negotiations with regional players like Saudi Arabia as well as the world’s powers on the nuclear program. The militias are gearing up for the upcoming elections and that they don’t want more problems that could defame their picture with the public as a ‘nationalist resistance movement,’ so they have left much of the work to the newly-formed groups.”

New groups could cause tension with existing groups, said Tamer Al Badawi, an analyst with the Carpo political consultancy in Germany.

“New groups represent another layer to the plausible deniability strategy that Iran and its local partners have been executing in 2020 in Iraq. It aims to depict a decentralised regional axis. Thus, it becomes more difficult to attribute attacks on US-led coalition forces in Iraq – with certainty.”

But, he said, it was unlikely that existing relations between Tehran and groups like Kataib Hezbollah had shifted.

"If Iran is establishing new groups, it has to be collaborative [with the PMF] to some extent, ie extra rewards, pro quid quos,' he said.