Mercedes-Benz debuted electric vehicles in 1906, and the brand is arguably the foremost pioneer of the automotive industry. Four-wheel independent suspension, supercharged engines, anti-lock brakes and electronic stability control are only a few of its innovations. Yet it seemed to take an eternity for the three-pointed star to re-enter the fray with a modern-day battery-powered car.

Mercedes's 20th-century relationship with electric power was short-lived, as the rapid progress being made with combustion engines at the time prompted the German carmaker to shelve plans for electric propulsion. But it's now back in the EV game with its all-new EQC 400 4Matic, which will go on sale next year. You could, however, argue that it's a bit late to the party, as rival carmakers such as Audi, BMW and Jaguar all have battery-powered vehicles on sale in showrooms across the world already.

Better late than never, though, and the EQC is the first salvo in an onslaught that will see the EQ family – "EQ" is Mercedes's shorthand for "electric intelligence" – grow to 10 models by 2022. It might not be first out of the blocks, but Mercedes isn't about to miss out on the mushrooming market for EVs, with electric cars especially popular in China, Europe and the US. We might be a little behind the curve in the UAE, but that will change as the recharging network grows and the country shifts increasingly towards clean energy generation. The government has set the target of achieving 50 per cent clean electricity by 2050.

Mercedes chose Norway as the international launch destination for the EQC as, by the end of last year, every second new car sold in the country was either a full-electric vehicle or a plug-in hybrid. The first thing you see in Oslo is an airport car park full of Teslas, Jaguar i-Paces and Audi e-trons. The EQC test fleet assembled for the throng of motoring journalists fits in fine.

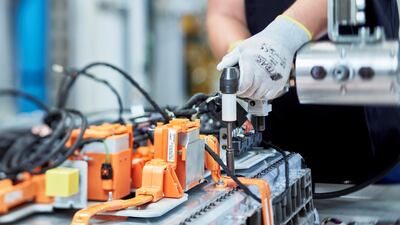

Although its source of motive power – two electric motors and an 80kWh battery pack – sits in stark contrast to the rest of the Mercedes range, the EQC 400 shares its basic structure with the GLC crossover. That said, the platform required significant re-engineering to slot in the bulky 642-kilogram battery pack under the passenger cell. That's the safest place for it, as it's protected on all sides by a crash structure that can keep the volatile pack intact in even the severest of collisions. The other advantage in having the battery pack down there is that it keeps the car's centre of gravity as low as possible, which benefits both handling and stability.

The initial impressions of the EQC, after getting about 50km down the road, are of how "normal" it looks and drives. Apart from the lack of engine noise – there's only a muted whine from the electric motors, similar to that of a remote-control car – there is nothing to suggest that it's ions rather than unleaded fuel doing all the work. As in other Mercedes cars, there's a column-shift auto with "P", "R" and "D" settings, and the accelerator and brake pedal are no different to the norm. The car also behaves conventionally in the default "Comfort" driving mode, but there's also "Sport", "Eco", "Individual" and "Maximum Range" modes, depending on whether you want to maximise range by recuperating as much energy as possible.

If aggressive driving is more your thing, you won't be disappointed, as the EQC's 760Nm torque quota (similar to the brutal AMG E63 S twin-turbo V8) practically forces your body into the seat back every time you step on the accelerator. It might weigh 2.5 tonnes, but the EQC leaps at the horizon with virtually the same urgency as a supercar. It's also surprisingly taut and agile for such a heavy car, not to mention supremely quiet and refined. Mercedes says it will do 0-100kph in 5.1 seconds, which is decidedly brisk for a five-seat family hauler. The EQC's rear seats are also suitably spacious, and its 500-litre luggage compartment is good, but by no means class-leading.

The EQC's touring range is quoted at 355km, but that depends heavily on how you drive the car. If you're flooring it all over town, expect to travel half that distance between recharges. It takes 40 minutes at a fast-charge station to boost the battery level from 10 per cent to 80 per cent, or overnight if you use a home Wallbox.

There aren't any glaring downsides in terms of how the EQC drives, but its styling might seem disappointingly conservative and mainstream. Mercedes hasn't used new design language for its first modern-day EV, apart from a new front fascia, and that's largely to avoid alienating its customer base. Other than this minor gripe, there's plenty to like about the EQC 400, even for a petrolhead.

The specs

Engine: Dual asynchronous electric motors, 80kWh battery pack

Transmission: Single-speed auto

Power: 408hp

Torque: 760Nm

Touring range: 355km (claimed)

Price, base: From Dh300,000 (estimate)

On sale: 2020