The pandemic may have led to a rise in baking but one Dubai resident is taking her love for the sweet stuff to a whole new level.

Ayesha Nemat Khan, who hails from India but was raised in Saudi Arabia, has spent the last few months experimenting with desserts that are almost too pretty to eat. And, being a big Harry Potter fan, she decided to celebrate July (which she considers Harry Potter month as his birthday falls on July 31) by whipping up some truly magical desserts.

"I've always had a lot of ideas when it comes to Harry Potter-themed desserts, and this year, since we were all at home anyway, I decided to start creating," says the 24-year-old.

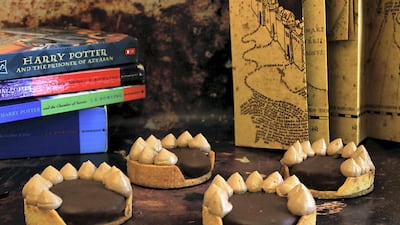

It began with Sorting Hat chocolate tarts that “sort” those eating it into the four Hogwarts houses. Each tart hides a coloured jam filling within – strawberry for Gryffindor, lime for Slytherin, lemon for Hufflepuff and blueberry for Ravenclaw.

She followed this with a Golden Snitch cake, which took her two days to complete – one day to make and another to decorate. The intricate creation features a tempered chocolate sphere, filled with Nutella mousse and salted caramel and topped with wings made from meringue. Fellow Potterheads will also appreciate the fact that she went the extra mile by making a “resurrection stone” out of sugar, using a hexagon silicon ice tray, and placing it in the centre of the dessert. (If you don’t get the “resurrection stone” reference, it’s time to brush up on your Potter trivia!).

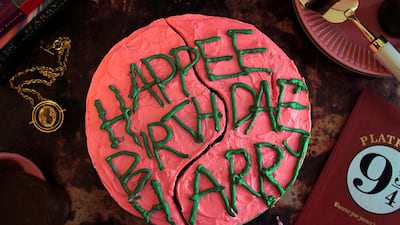

Her latest creation is the perfect tribute to the boy wizard's birthday; the “Butterbeer Cake” is decorated just like the one Hagrid gets Harry for his 11th birthday when he tells him that he’s a wizard – complete with the misspelled text and the bright frosting. “It’s a brown sugar cake with brown butter Swiss meringue frosting and butterscotch sauce,” she explains.

Khan works as a marketing executive at a technology startup, and has never had any formal culinary training. However, she has always had a penchant for baking, and has a family business called Cake Away located in Silicon Oasis.

“When I was young, I’d make box cakes, and as I grew up, I was looking for new things to try. As the years passed, I kept trying new things and experimenting. Instagram has been a big catalyst,” she says.

Khan says she’s learnt much of her technique through YouTube videos, social media and recipe books, and started “seriously” baking in 2016 after she made a three-layered cake for a friend's birthday.

However, it was the pandemic that made her turn her attention to intricate desserts that look more like artwork – all made in her home kitchen. Some examples are a pistachio mousse and vanilla cake within a sugar globe (a dessert that took days to perfect and gave her sleepless nights) and a chai parfait with Parle-G biscuits.

“The pandemic has been a big reason behind this series. The world seemed to slow down, I had more time to read, and learn. This is a project that has been on my mind for a while now, and I finally got time to do it,” she says.

“I like to create desserts with nostalgic flavours, something we enjoyed as a child, or something that we enjoy eating but would never think of as a dessert,” she adds.

So what happens when she completes her scrumptious dessert? “We eat it, of course,” she says. “Breaking it up and savouring it is as satisfying as putting it together! I stay with my brother and his wife, so we just polish off the entire thing.”

With July 2020 wrapping up, we may not get to see any more extraordinary Harry Potter creations, but Khan has already set her sights on her next challenge – desserts inspired by Disney movies. "I'm super excited," she says.