Green and sustainable finance issuance, aimed at environmentally friendly projects, grew 32 per cent in the UAE last year, compared with 2021, according to Arthur D Little.

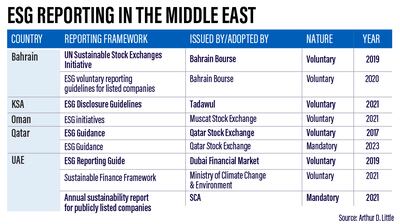

Major public and private institutions in the UAE, including the Dubai Financial Market, the Ministry of Climate Change and Environment, and publicly listed companies in the Securities and Commodities Authority, have shown an increase in environmental, social and governance standards (ESG) reporting, the consultancy said in a report on Monday.

“Green issuances from countries in the Middle East and North Africa are not standing still but are, in fact, outpacing global growth,” said Andreas Buelow, a partner at Arthur D Little.

“With new reporting requirements taking effect, banks are facing an urgent need to kick-start their strategies and execute concepts throughout their organisations.”

Less than two weeks ago, Dubai Islamic Bank, the UAE’s biggest Sharia-compliant lender by assets, raised $1 billion from its second sustainable sukuk as it continues to diversify its financing base.

In September, Abu Dhabi Commercial Bank, the country's third-largest lender, priced its debut $500 million green bond that will help it finance projects following ESG standards.

Last year, First Abu Dhabi Bank, the UAE's largest lender by assets, provided a multimillion-dollar green trade credit line to wind turbine maker Senvion India, as part of the bank's efforts to advance its net-zero ambitions.

The global sustainable finance market, which was valued at $3.65 trillion in 2021, is projected to hit $22.48 trillion by 2031, growing at a compound annual rate of more than 20 per cent between 2022 and 2031, according to Allied Market Research.

Green bond and sukuk issuances from the GCC hit a record in 2022 at $8.5 billion from 15 deals, compared with $605 million from six deals in 2021, data from Bloomberg’s Capital Markets League Tables showed last month.

“Many financial institutions in the Middle East have designed comprehensive ESG strategies that open the door to new pathways to top-line growth, business opportunities, cost reductions, regulatory compliance and employee satisfaction,” said Nael Amin, senior manager in the financial services practice at Arthur D Little.

“This growing trend demonstrates the momentum that ESG is gathering in financial institutions, as the world’s banks increasingly emphasise ESG and infuse it into their business models.”

The issuance of green bonds in the Middle East region grew by 38 per cent between 2016 and 2020, and in 2020 alone, Middle Eastern governments drove 97 per cent of green bond issuances, compared with 13 per cent four years earlier, according to the Boston Consulting Group.

“Banks in the Middle East have embraced the importance of a well-defined ESG strategy. During the next step, implementation, frameworks such as data governance are vitally necessary,” said Mr Amin.

Arthur D Little said that $24.55 billion in green and sustainable finance was generated by the Mena region in 2021, a more than sixfold increase from $3.8 billion in 2020.

The Emirates is investing Dh600 billion in clean and renewable energy projects over the next three decades as it aims to achieve net-zero emissions by 2050.

It is building the Mohammed bin Rashid Solar Park in Dubai with a capacity of five gigawatts.

Abu Dhabi, which is developing a two-gigawatt solar plant in its Al Dhafra region, has set a target of 5.6 gigawatts of solar PV capacity by 2026.