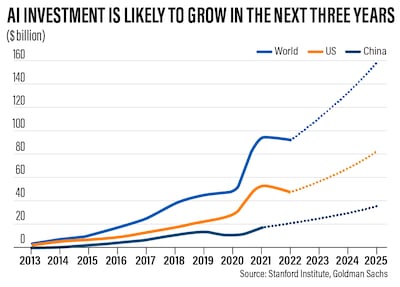

Global artificial intelligence investments are projected to hit $200 billion by 2025 and could possibly have a bigger impact on gross domestic product, a study has revealed.

AI investments will possibly take a few years to have a major impact on the economy, rising from a relatively slow starting point, Goldman Sachs Economic Research said in a report.

But for AI to trigger large-scale transformation, businesses need to make “significant upfront investments in physical, digital and human capital to acquire and implement new technologies and reshape business processes”, the US bank's economists Joseph Briggs and Devesh Kodnani wrote in the study.

“Those investments, which could amount to around $200 billion globally by 2025, will probably happen before adoption and efficiency gains start driving major gains in productivity.”

In the long term, AI-related investments could peak as high as 2.5 per cent to 4 per cent of gross domestic product in the US and 1.5 per cent to 2.5 per cent in other countries that lead in the technology, if the research's growth projections are fully realised, Goldman Sachs said.

“The US is positioned as the market leader in AI technology, and American companies will likely be relatively early adopters,” Mr Briggs and Mr Kodnani said.

“While a similar effect could also play out in other AI leaders [such as China], the investment impact will likely be smaller and more delayed.”

Generative AI, in particular, has “enormous” economic potential and could boost global labour productivity by more than 1 percentage point annually during the decade following widespread usage, Goldman Sachs had previously said.

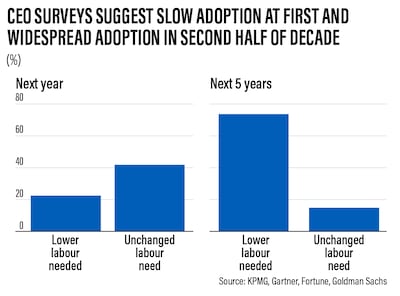

Surveys of chief executives in the US showed that less than a quarter expect generative AI to affect their company or lower their labour needs over the next one to three years.

However, a significant majority of them expect to have adopted AI over a three to 10-year time frame.

“If those timelines are correct, then AI adoption would likely start having a meaningful impact on the US economy sometime between 2025 and 2030,” Goldman Sachs said.

AI has long been used by businesses in their operations but it has gained momentum with the advent of generative AI.

The technology – made popular by ChatGPT, created by Microsoft-backed OpenAI – can produce various kinds of data, including audio, code, images, text, simulations, 3D objects and videos.

Investors have put more than $4.2 billion into generative AI start-ups in 2021 and 2022 through 215 deals after interest surged in 2019, recent data from CB Insights showed.

Market interest in AI continues to rise rapidly. In the US Russell 3000 index alone, more than 16 per cent of companies have mentioned the technology in their earnings calls, up from less than 1 per cent in 2016 – with about half of that increase coming after the release of ChatGPT in November 2022, Goldman Sachs said.

Its potential is already being flagged in other regional economies. GCC countries, for instance, are expected to reap about $23.5 billion in economic benefits by 2030 as investments in generative AI continue to grow, PwC unit Strategy& Middle East said in a report last month.

Meanwhile, the “most promising” 50 private generative AI companies are working on a broad spectrum of sectors, including in media and entertainment, drug discovery in health care, the development of AI assistants and human-machine interfaces and generation tools, according to CB Insights.

“Our economists expect AI investment to largely come from hardware investment to train AI models and run AI queries, as well as increased spending on AI-enabled software,” Goldman Sachs said.

AI investments are expected to be concentrated in four key business segments – companies that train and develop AI models, those that supply the infrastructure (such as data centres, to run AI applications), companies that develop software to run AI-enabled applications and enterprise end users that pay for those software and cloud infrastructure services, the study said.

“While the timing of the AI investment cycle is hard to predict, business surveys suggest that it’s likely to start having an investment impact in the second half of this decade, with earlier adoption by larger firms in information and professional, scientific and technical services,” Goldman Sachs said.