India's online insurance industry is expanding and attracting keen investor interest, as start-ups try to corner a market that remains relatively untapped in a country where the vast majority of the population is uninsured.

“There is a significant market expansion opportunity that new entrants have created to make a meaningful dent in insurance penetration,” says Utkarsh Sinha, managing director of investment bank Bexley Advisors.

Despite India being the world's most populous nation, with more than 1.4 billion people, the country's insurance industry is only the 10th largest in the world, according to a report by PwC.

India's life insurance market penetration stands at 3.2 per cent, PwC's data shows, while non-life insurance penetration is 1 per cent. It attributes to this “increasing protection deficit and limited distribution reach”.

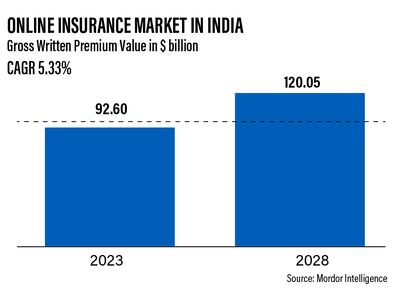

But this also creates a major opportunity for growth – and the market is expanding rapidly.

In the financial year to March 2023, the country's general insurance and life insurance markets rose by 16 per cent and 18 per cent respectively over the previous year, according to PwC.

The rise of India's insurance industry is important for the growth of the country's economy, it notes.

The sector is expected to expand over the coming decade, with its growth fuelled by easing regulatory policies, fast-paced digitisation efforts and increased awareness among customers, PwC says.

“Post the Covid-19 pandemic, there has been an increased awareness about the importance of insurance,” says Ankur Mittal, a partner at Physis Capital, a fund that invests in India's start-ups.

“This is attributed to factors like enhanced accessibility through online distribution, competitive pricing, simplified policy terms, and growing public awareness.”

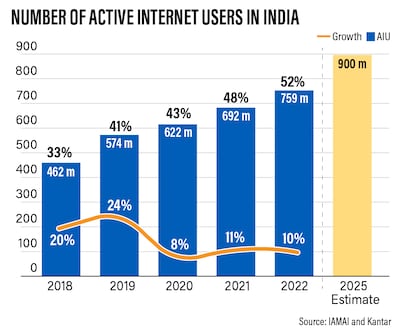

As India's number of internet users rapidly increases, this has created an opportunity for start-ups and established insurance companies to reach more potential customers across the country through the internet and increase their use of digital technology.

Many start-ups in the insurance space are focused on acting as online marketplaces, selling insurance products for various providers.

These include companies such as online insurance broker PolicyBazaar, which listed in 2021. But there are also other areas in this space for digital-focused companies.

“InsurTech has evolved beyond merely online aggregation, encompassing various segments, including underwriting, specialised insurance providers, analytics services and health-focused InsurTechs,” says Mr Mittal.

As the sector and the role of technology evolves, investors are pumping funds into the industry, which has become one of the most attractive areas in the FinTech landscape, experts say.

India's InsurTech sector is expected to grow by 17 per cent annually to reach $307 billion by 2030, according to a report by start-up information platform Inc42 Media.

“InsurTech is a hot space in India right now,” says Tejas Jain, founder of BimaKavach, an online platform business that provides insurance quotes from top insurers.

“This sector holds promise due to the growing awareness of insurance among businesses and consumers, as well as the evident inefficiencies in traditional systems that technology can solve.”

founder of BimaKavach

Mr Jain describes the sector as ripe for disruption and digitisation.

Amid investor interest, Indian start-up InsuranceDekho – an online platform that allows users to compare and buy insurance policies from companies providing car, health, life and travel insurance and other policies – last week raised $60 million in Series B funding round, valuing the company at more than $650 million.

Earlier this year, InsuranceDekho raised $150 million.

Japan's Mitsubishi UFJ Financial Group and insurer BNP Paribas Cardif were among the investors that participated in the round, alongside existing investors including TVS Capital and Goldman Sachs Asset Management.

This month, Indian InsurTech start-up Onsurity also raised $24 million in a funding round led by the World Bank's International Finance Corporation.

This comes despite India's start-up sector more broadly experiencing a slowdown.

Also helping to drive the industry is the Indian government, which is working to get more of the population insured.

Last November, the Insurance Regulatory and Development Authority of India (IRDAI) made a commitment to enable “Insurance for All” by 2047.

The IRDAI, the regulator for the industry, said its aim is for every citizen to have “an appropriate life, health and property insurance cover and every enterprise is supported by appropriate insurance solutions and also to make Indian insurance sector globally attractive”.

To achieve this, it said that “efforts are being made towards creating a progressive, supportive, facilitative and a forward-looking regulatory architecture to foster a conducive and competitive environment leading to wider choice, accessibility and affordability to policyholders”.

Abhishek Poddar, co-founder and chief executive of insurance technology platform Plum, says insurance is critical for a country to transition from a developing to a developed economy.

“Investors are clearly seeing the potential the sector holds,” he says. “The recent fund raise in the sector by our peers is a testament to that.”

Online companies like his are working to disrupt India's insurance industry, which has long been dominated by traditional companies, he says.

Among the traditional firms is Life Insurance Corporation (LIC), which pulled off India's biggest initial public offering last year, raising around $2.7 billion after the government sold its 3.5 per cent stake in the state-controlled insurer.

Established in 1956, LIC has sold 280 million policies and is the world's fifth-largest insurance company in terms of insurance premium collections.

Mr Sinha of Bexley Advisors says that it will be hard for digital players to challenge the commanding lead held by LIC and Postal Life Insurance, run by Indian Post.

“Their network spread is unparalleled,” he says. “Disrupting that takes a lot of sales might, which translates to high equity funding requirements for the aspirants. It's not something that can't be done – many are trying to do it. But it is a non-trivial challenge.”

But traditional insurers are being impacted by the rise of digitisation in the sector.

Companies such as LIC are still heavily dependent on selling policies through agents, and analysts say that insurers that are putting more focus on digital initiatives – which can also be much more cost-effective, as well as having a potentially wider reach – are at an advantage.

This is reflected in LIC's share in monthly new business premiums in the life insurance sector falling to 58.50 per cent last month, from 68.25 per cent a year earlier.

To keep up with the changes, LIC chairman Siddhartha Mohanty told India's Economic Times newspaper that the company would be “working towards digital transformation of all operations so that we move to 90 per cent digital in the next three years”.

But overall, Mr Mittal says that “incumbent insurers have been slow in their digitisation efforts, leading to inefficiencies, manual data entry, and higher operational costs”.

Policy Ensure is an insurance distribution company in India that straddles the digital and traditional insurance models, having a physical presence in the locations it serves, while also offering a technology platform.

Its aim is to help increase insurance penetration in India, particularly in smaller cities and towns across the country.

“India's digital growth, expanding middle class, and underserved market, combined with supportive regulations, make it an ideal landscape for innovative insurance solutions,” says Pankaj Vashistha, co-founder and chief executive of Policy Ensure.

He says that the company is seeking to raise up to $30 million over the next year to fund its expansion plans.

However, it is not an easy market for companies to crack.

“The first challenge was navigating the regulatory landscape of the insurance industry,” says Mr Vashistha.

“As a highly regulated market, it was crucial for Policy Ensure to ensure compliance with the regulatory requirements, which involved a time-consuming process.

“The second challenge was related to internet penetration, particularly in the tier two and tier three [small] cities.”

But India's number of internet users is only set to expand over the coming years – projected to reach 900 million by 2025 from 759 million last year, according to data from IAMAI and Kantar – which bodes well for India's digital insurance market.