Are you funding someone else's lifestyle?

Fair play if they're doing a great job investing it and in return funding yours. Not so if it's more take than give.

Sometimes it's blatantly obvious what money goes on. Do you remember the billboards screaming a luxury car to go with a flat - the flat you pay for, the car would be "free".

So let's see - that would be the punter paying for the car, the billboard, the admin to sort it all out, and the overheads to house them.

I'd much rather have the discounted property, thank you very much. Plus the potential thrill of a beast of a car is somewhat dampened if the basement is full of them.

At least that sort of ploy is bleedin' obvious; public enticement - that you pay for - at its most blatant and transparent.

The real problem is when we are clueless about how our money is spent when we buy into "good" investments. Like funds. Good for who exactly?

To put it bluntly, we are the last to get paid. We get what's left over after overheads; office space, salaries, admin, and - the all-important entertainment, put on to entice more investors to part with their money - is paid for. Where does hospitality stop, and bribery begin? And who's paying for all this anyway?

Six months ago the UK's Financial Conduct Authority warned fund managers about lavish corporate spending. This is on the back of rules the authority published a year earlier defining gifts or hospitality that are of "unreasonable value". But fund managers haven't stopped. In this region, you can imagine what they dream up ... with golf being the lesser of the lavish offerings. I wonder how many Abu Dhabi Grand Prix corporate invitations went out from fund managers looking to win investor money. This spending pales into insignificance when footing the bill of private concerts with household name bands, for example.

It'd be OK if the funds paid for it themselves. But they don't. You do. You, the investor, foot these bills because it comes out of money made before you're paid.

This is why Niels Jensen, the chief investment officer of Absolute Return Partners, says management fees must cover the cost of running a fund management business, nothing more. It's all in the definition of "running" though isn't it?

Another thing is that this sort of expense is not disclosed to us. Perhaps you can ask for it the next time you look to buy into a fund.

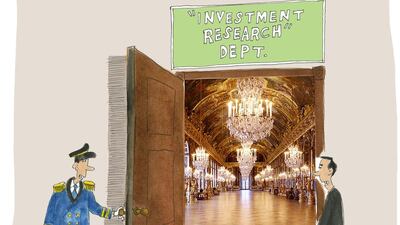

It's things like "investment research" you need to look out for.

The UK's FCA estimates that £1.5 billion (Dh6.87bn) was spent on it in 2012. This is over and above charges agreed to be paid to investment managers.

And here's the kicker: guess who got paid to carry out and provide the findings of said "research"?

If I were a cynic I'd say the very people selling us the investments ...

Hang on ... Nail. Head. Hit.

You might think it's a good thing to have, this sort of information.

Have you ever bothered to read any? If you get beyond the headline then you're in a minority ... I'd venture to say that, beyond the person who wrote it, no one reads it in its entirety. Oh it'll be used, in an unfortunate indictment of the media, usually by those wishing to fill column space.

Some investors - not enough - are wising up to this system that pays us last. This could account for more going the route of passive funds. The Investment Association, the UK's trade body for fund managers, finds that passive funds increased their market share to 23 per cent of total assets. It was a fifth in 2010. Not surprising as they have significantly lower fees, lower overheads because they need less manpower to manage. In the US, passive funds have a third of the market, up from a quarter three years ago.

And there's more change afoot. Let us focus on hedge funds. October was the worst month for hedge funds so far this year - 61 per cent of those taking part in an industry-wide survey reported having net outflow - more money was taken out than put in by investors. This was the fifth month in a row, and the seventh month this year for this to happen. Could it be that this crisis is down to investor sentiment? They have had enough and want out. Or, as is being mooted, that it's because there's less allocation of funds. Regardless, here's what the research company that carried out the report had to say:

"The issues of expensive access to increasingly marginalised and potentially replicable returns streams, has and will continue to force change. Savvy institutional investors have more choices, more technology and more influence on their side than ever before. The largest allocators may find it more cost effective to bring resources in-house rather than to pay fees for mediocrity."

The way the investment industry works is flawed. We the investor, are being abused. Time for the system that feeds the fat cats before us to change. I don't believe the "fun" in fund means those managing get to live it high at our expense. Here's a simple call to action: fund our lives first. If they don't. Vote with your money. Take it out.

Nima Abu Wardeh describes herself using three words: Person. Parent. Pupil. Each day she works out which one gets priority, sharing her journey on finding-nima.com.

pf@thenational.ae

Follow us on Twitter @TheNationalPF

Run through the fine print when you invest

Invest your money but do so carefully - you don't want to fund someone else's lavish lifestyle in the process.

Most popular today