Average rents for prime properties in 10 key markets around the world are increasing at rates up to three times what they were only a few years ago, a survey has found.

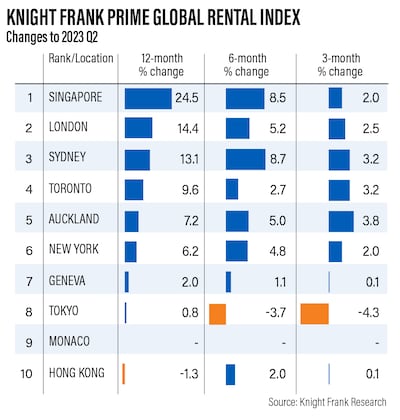

The Prime Global Rental Index for the second quarter from the international estate agents Knight Frank shows average prime rents in key world cities rose 7.5 per cent in the 12 months to June.

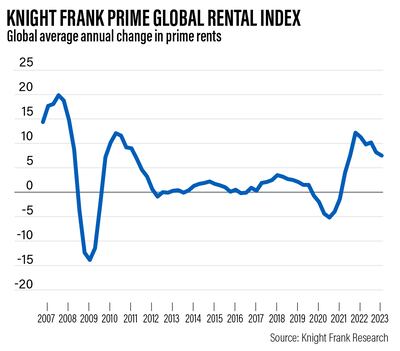

The overall growth rate is falling, down from 8.2 per cent in the first quarter and from 12.2 per cent in the first three months of last year, but is still more than three times the average trend of 2.2 per cent between 2010 and 2020.

At 23 per cent, the overall growth in the Index in the past two years has been "remarkable", said Knight Frank, with New York, Singapore and London recording rental growth of 56 per cent, 53 per cent and 51 per cent, respectively, over the same period.

Rental demand has been driven by people returning to cities following the pandemic lockdowns, with many potential and prospective buyers squeezed out of the house-buying markets in recent times by rising interest rates.

Meanwhile, delays to construction schedules during the pandemic have somewhat crimped the supply of rental properties.

"Housing rents have risen by more than 50 per cent in key global cities in just two years, and are continuing to rise at three times their pre-pandemic rate," said Liam Bailey, Knight Frank’s global head of research.

"Affordability of housing is set to become the leading political issue within the next 12 months.

"The need for honest conversations about real supply-side solutions is becoming critical.”

Down Under bucks trend

However, despite the surging growth figures over the past two years, the current rates are more moderate.

For example, in Singapore, annual growth eased from 31.5 per cent in the first quarter to 24.5 in the second quarter.

Likewise, growth in London rents has decreased from 16.9 per cent to 14.4 per cent and in New York, the rate of growth slowed from 10.6 per cent in the first quarter to 6.2 per cent.

Nonetheless, Sydney had a surge in annual growth from 11.7 per cent to 13.1 per cent in the second quarter while rentals in Auckland, which had experienced a decline in the first quarter, posted a growth of 7 per cent in the second quarter.

Knight Frank said material and labour costs and shortages have caused delays in construction project deliveries, meaning that in most of the 10 cities in the Prime Global Rental Index, "tenants will face high rents for the foreseeable future".