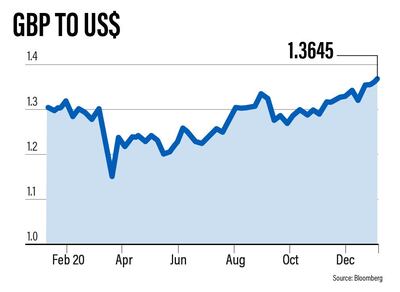

The British pound strengthened against the US dollar on Britain’s first day of trading outside the European Union but weakened against the euro amid warnings of tightened lockdown measures.

While sterling rallied against the dollar in early trading, breaking above $1.37 for the first time since May 2018, the gain was later pared back with the pound trading at $1.3645 at 1.07pm London time, a drop of 0.2 per cent. Meanwhile, it was 0.82 per cent down against the euro at €1.1093.

“The pound has started the first day of the year in a cautious mood, rising only slightly against the dollar and falling against the euro," said Fawad Razaqzada, market analyst at Think Markets.

"The latest lockdowns have dampened investor enthusiasm towards the pound, especially as Prime Minister Boris Johnson warned of tougher new measures to control the Covid surge across the UK.”

The pound has strengthened against both the dollar and euro since the EU trade deal was finally agreed on Christmas Eve, cementing new trading rules.

Although the deal does not cover finance, an extension was applied last week allowing financial services companies to use platforms in the EU for swap trading until March 2021.

Despite a record number of Covid-19 cases and warnings of even tighter movement restrictions to control the spread of the virus, Mr Razaqzada expects sterling to rise further over time “as investors continue to price out the risks of a no-deal Brexit”.

“As a minimum, I think $1.40 is where the GBP/USD could easily rise to before we see any real troubles,” he said.

However, John Goldie, FX dealer at Argentex, said he was “not convinced that there is much more upside yet”.

“At these levels it may be difficult to continue to push higher with further escalations in the Covid numbers and the prospect of longer, more stringent lockdowns to come," Mr Goldie said.

"In that respect, while I do anticipate further upside for the pound this year, including a comfortable return into the $1.40s, I suspect that the virus will keep things under wraps as we start the new year.”

Commerzbank's head of FX and commodity research Ulrich Leuchtmann said sterling's rally after the Brexit trade deal was "disappointingly limited", but that it has further scope for gains in the next few days as traders adjust positioning upon their return from holiday.

Meanwhile, stocks in London rose sharply on Monday amid optimism over the distribution of a second coronavirus vaccine.

The FTSE 100 index of larger companies rose 3 per cent in early trading, while the more UK-focused FTSE 250 rose 1.5 per cent. The surge tapered off later in the day with the FTSE 100 sitting at 6,634 at 1.18pm London time, a rise of 2.7 per cent, and the FTSE 250 up 1.08 per cent at 20,709.

Adrian Lowcock, head of personal investing at Willis Owen, said the year had started with a bang as the UK markets rallied following Britain’s exit from the EU, and the country felt more hopeful about the end of the Covid-19 crisis.

"Investors should temper any excitement in markets though, as today’s enthusiasm may not last. The global economy faces many challenges even once the pandemic has passed,” he said.

"For market participants with a long-term outlook the concern that Brexit might constitute the beginning of renewed economic decline in the UK is more likely to dominate."

Naeem Aslam, chief market analyst at Avatrade, said investors must keep in mind that the Covid-19 situation in the UK “is still getting out of hand”.

“The fact is that it will take some time to bring the coronavirus situation under control, and that means full economic recovery may not be able to get back fully on track until Easter this year,” he said.