Patrick Chalhoub is a family man.

He sits down to eat every evening with his wife, even if he goes out for dinner on business.

He has two sons, and takes them on annual discovery holidays to places such as the historic Machu Picchu site in Peru and safari parks in South Africa.

He owns a golden retriever called Speedy who is also very much part of the family.

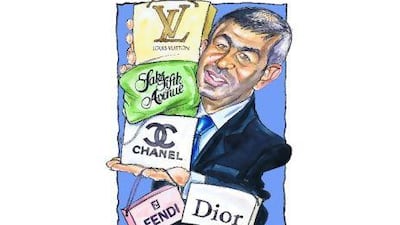

Mr Chalhoub, 54, is the co-chief executive of the Chalhoub Group, and alongside his brother, Anthony, he has helped to shape his parents' business for more than 30 years into what is now the biggest luxury retailer in the Middle East.

"I enjoy spending time with my family, whether it be with my wife, chatting about our day, reading, travelling, or be it with my children as well. Family occupies a large part of my life. Much more today than it used to do 10 or 20 years ago."

Sitting in a plush office at the company's headquarters in Jebel Ali, Mr Chalhoub politely offers coffee and inquires about his visitor's New Year's Eve activities.

Upmarket white and dark chocolates adorn the coffee table, alongside huge hardback books by major luxury brands such as Christian Dior.

Mr Chalhoub, dressed in a smart blue suit, crosses his legs and leans back on the sofa while constantly using his hands to describe a fact or anecdote.

He likes blue. His suit, shirt and spotted tie are also blue.

But his mood is nothing like the colour of his attire. He seems most content, most animated and most engaging when he talks about his wife, sons and extended family.

"We have a family house in the south of France, which is owned by my parents, where we all meet in the summer, with my brother, his children, my children. It's tradition since the birth of our first child, which is my elder son," Mr Chalhoub says. "There are a few occasions, be it at the family mansion, a discovery trip or some sporting event, which put us together. We also always spend Christmas together at home."

Mr Chalhoub entered the family business in 1979 when the group had just 100 employees. His brother had joined three years before when it had 30.

The group now has more than 7,000 employees in the Middle East, with about a third of them in Dubai. Through partnerships with global brands such as Chanel, Fendi, Christian Dior, Louis Vuitton and Saks Fifth Avenue, Mr Chalhoub estimates the group has a 20 per cent market share in luxury retail in the region.

"You have to give him credit," says Mohi-Din BinHendi, the president of BinHendi Enterprises, talking about Mr Chalhoub. "He's focused on what he's doing, he's friendly and a good man."

Mr BinHendi, who has been a player in the luxury retail sector for more than 30 years in the Middle East, says Mr Chalhoub's wife, Ingie, is also known to have a shrewd retail mind. "She's known as a tough lady. She does not take any fooling around."

Mr Chalhoub's eldest son, Michael, who is the chief executive of Sport360, says his father has a clear order of priorities in his life, starting with his wife, then his two sons, his extended family, his work and finally, his health.

"We always have an understanding that there's not much in quantity of time together, but the quality is always there," says Michael. "His family life comes above all."

The Chalhoub empire began in Damascus in 1955. Set up by Mr Chalhoub's Syrian parents, it has since been headquartered in Lebanon, Kuwait and Dubai.

A mathematician and physicist, Patrick Chalhoub did not always want to join the family retail and distribution business, particularly when he was a student in Paris.

"I thought about moving more into mathematical research or research of the brain," he says. "But I came back to reality and asked: can I make a living out if it? Is it really what interests me? So I decided I was going to move into the family business with a lot of support at home."

Although Mr Chalhoub did not feel forced into joining the business, he concedes there was pressure to do so. But he and his brother initially lived in the same house with his parents and had the support network and mentoring to build the business.

"My brother and I have worked very closely with our parents, and this has helped a lot in establishing a working relationship among ourselves," Mr Chalhoub says of the group's joint chief executive management structure.

"We respect each other a lot and know each other extremely well, our strengths and weaknesses. It's not the easiest situation, but it is very dynamic and we get the best out of it."

The brothers do occasionally disagree.

"We might have a clash on a daily basis, but fundamental clashes, I do not remember ever having," he says.

Michael agrees that although the brothers are quite different, they work well together in business - which is proved by the longevity of their tenure as joint chief executives.

"They complement each other a lot," he says.

The joint chief executives speak with each other every day and strategically review the business four times a year. They avoid talking shop when they are with their families and likewise try to keep the tumult of family life separate from the office.

Like Patrick, Anthony has two sons, so from an outside perspective the question of management succession might seem a tricky one. But Patrick has a clear view when it comes to his own children.

"The philosophy I have developed with my wife about our children is to say [their position] is neither an obligation or a right. And I think as a philosophy it's very important," he says.

"It's not an obligation. If they don't like the business, they shouldn't go into it, but it's not a right that because they are a member of the family, they will occupy a position."

For now, Michael says he is content to be the chief executive of Sport360, but would be "honoured" to work in the family business in the future.

His father is one of a number of financial backers in Sport360 and is always ready to offer advice on the business or his son's career.

"He told me I should not follow anything other than my dream," says Michael.

The Chalhoub Group is trying to clearly separate the ownership, which will remain within the family, from the management, which is open to anyone of merit.

"For us, it will be the third generation, which is always the most critical. It makes or breaks [the business]," says Patrick. "What I am trying to implement on myself and others is go for your passion, what you like and inspires you."

From a luxury perspective, that means a different brand for a different purpose or item of clothing, he says.

As the head of a luxury goods empire, does he have a favourite brand?

"It depends on the moment and what I am looking for today," he says, struggling, for once, to come up with a coherent response.

"If it is the values portrayed from a brand - for me its totally Louis Vuitton, but I don't wear many products of Louis Vuitton. The simple answer is follow what you like for yourself and not for others."