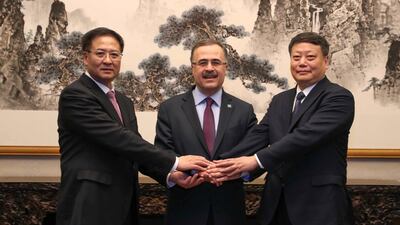

Saudi Aramco agreed to form a joint venture to develop a $10 billion integrated refining and petrochemical complex in China as well, as take a 9 per cent stake in another refinery, as part of a broader push by the world's largest crude exporter to acquire lucrative downstream assets in Asia.

Aramco will develop a 300,000 barrel-per-day refinery in China with a 1.5 million tonne-per-annum ethylene cracker and a 1.3 million tonne-per-annum paraxylene unit alongside Chinese companies Norinco Group and Panjin Sincen.

The Saudi producer will have a 35 per cent interest in the new company, Huajin Aramco Petrochemical, with Norinco and Panjin Sincen holding 36 and 29 per cent stakes each.

Aramco would supply up to 70 per cent of the crude feedstock for the complex, which is expected to start operations in 2024.

Saudi Aramco also signed an agreement with the government of the Chinese province of Zhoushan to acquire a 9 per cent stake in an 800,000 bpd capacity integrated refinery and chemicals complex.

The Saudi firm signed a long-term crude supply agreement with shareholders of the Zhejiang Petrochemical company that operates the refinery. The agreement had a provision allowing for Aramco to utilise Zhejiang Petrochemical’s large crude oil storage facility to serve its Asian customers.

Aramco will also enter China’s retail fuel segment following an agreement with Zhejiang Energy to, which includes building up a network over five years in the same province. The retail segment will eventually be integrated with the Zhejiang Petrochemical complex, the statement added.

Commenting on Aramco’s $10bn refinery investment, Saudi Aramco chief executive Amin Nasser said, "Our participation in the integrated refining and petrochemical project in Panjin will strengthen our collaborative efforts to enhance energy security, revitalise key growth sectors and industries in Liaoning and also meet rising demand for products and goods in China’s Northeast region."

Saudi Aramco, which produces and sells crude on behalf of the kingdom has begun to increasingly deploy resources towards developing integrated refining and chemicals schemes at home as well as abroad, as it looks to earn more from the sale of products, which have large markets in Asia. Aramco, which is in the process of acquiring 70 per cent of Sabic, the region's largest chemicals company, is also in the process of developing a large-scale downstream complex in India.

The Saudi state producer partnered with Abu Dhabi National Oil Company last year to invest in a $44bn integrated refining and chemicals complex on the west coast of India, along with a consortium of domestic state-backed refiners.

The Zhejiang Petrochemical refinery in which Aramco is invested includes a newly built 400,000 bpd refinery with a 1.4 million tonne per annum ethylene cracker as well as a 5.2 million tonne per annum aromatics unit. The second phase will see addition of a further 400,000 bpd capacity, with a "deeper chemical integration,” Aramco said in a statement.

In China, Aramco said there were additional plans to establish a fuel retail business that will be integrated into the value chain.

By year end, a three-party marketing joint venture will be formed by Aramco as well as Chinese firms North Huajin and Liaoning Transportation Construction Investment Group Company to develop retail fuel stations in target markets.

_____________

_____________

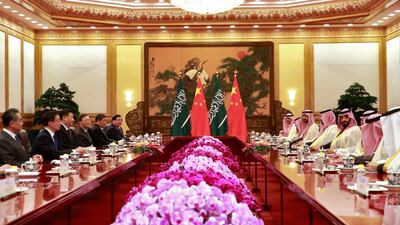

The deals, which follow the visit of Saudi Crown Prince Mohammed bin Salman to China, following a tour of Pakistan and India also saw the signing of a memorandum of understanding between Saudi Arabia's Public Investment Fund and the Chinese government on investment in renewables.

Saudi Arabia would invest in renewables, making it a "leading global centre" for the sector, the SPA state news agency said on Friday.

The agreement would enable the Saudi sovereign wealth fund to support, develop manufacturing, power generation and emerging technologies over the next ten years, the report added.