As India's deadly second wave of Covid-19 infections shows no signs of abating, industrial companies are shifting priorities to help manage the crisis.

From oxygen supplies being diverted from sectors including steelmaking, to the country's IT industry deploying its tech systems and manufacturers directing their focus to producing goods to help India through the pandemic, corporates are rallying to address the enormous challenge.

“India is facing a humanitarian crisis of massive proportions,” says Gaurav Singh, chief executive and founder of Verloop.io, a Bangalore-based chatbot application, which is now focusing on using its platform to help connect those who need oxygen and those who have it, at no cost. “As human beings and corporations, now is the time for us to work together.”

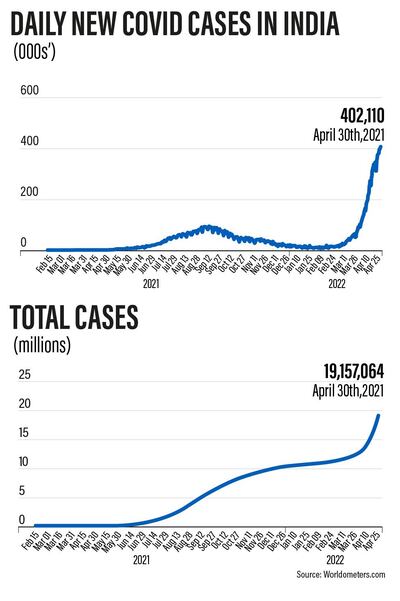

India on Saturday recorded a global daily record surge of 401,993 new Covid-19 infections and 3,523 deaths, according to figures from the country's health ministry.

As case numbers spike, hospitals are reporting severe shortages of beds, medicine and oxygen, leading to loss of life.

Analysts say that industry has a critical role to play in addressing the crisis, as the Indian government struggles to cope. The country's healthcare system was overstretched even before the pandemic.

“The Indian private sector has always worked hand in hand with the government during any moment of crisis and Covid-19 is another example where [it] has stepped up efforts with money, innovativeness and efforts across all fronts,” says Sunil Chandiramani, the chief executive of Nyka Advisory Services and former national leader of EY India's advisory services arm.

Steelmakers are among those that have had to change tack, as the government has ordered industries to limit the use of liquid oxygen so that it can be diverted for medical purposes.

Steel plants have responded accordingly and many are going above and beyond the demands of the government.

India's largest steelmaker by market value, JSW Steel, says that it is ramping up production of liquid oxygen. In April, it supplied more than 20,000 tonnes of liquid medical oxygen from its plants to state governments and hospitals treating Covid-19 patients, the company says.

It is now supplying 1,000 tons of liquid medical oxygen a day. The company says it will prioritise these needs even it it means this will negatively impact steel production.

The company is “committed to augment the supply of liquid oxygen further in these critical times to save lives even by lowering the production of steel”, JSW said in a statement. “We are leaving no stone unturned to push the supply of liquid oxygen in the interest of our nation”.

For one of India's oldest conglomerates, Godrej Group, the pandemic has forced it to be constantly ready to shift strategy as new challenges emerge.

“We've improved our ability to adapt and create flexible operating systems to manage through the twists and turns of the crisis,” says Anil G Verma, the executive director and president of Godrej & Boyce. “With the second wave underway, we are drawing on the learnings over the last year to anticipate the possible scenarios and prepare ourselves to meet them.”

When the pandemic first hit India last year, the company was forced to re-evaluate its activities.

“We manufactured ventilator valves in response to an urgent requirement from the industry – something which was a first for us,” says Mr Verma. “The country needed to ramp up its healthcare infrastructure.”

It supplied more than 9,000 hospital beds to medical facilities across the country and some 10,000 medical refrigerators for storage of vaccines.

Meanwhile, the Serum Institute of India, which is producing the Oxford-AstraZeneca vaccine locally, has reduced the price of the Covid-19 vaccine for state governments in response to the current crisis. Hyderabad-based Bharat Biotech, which produces India's homegrown shot Covaxin, followed suit.

India officially opened up its vaccination drive to everyone over the age of 18 on Saturday, although many states are struggling with vaccine shortages. India has temporarily halted Covid-19 vaccine exports, although it exported tens of millions of doses earlier this year.

The Serum Institute, however, has plans to start vaccine production in other countries to meet demand, according to a report in UK newspaper The Times. India's vaccination programme is seen as it best hope of battling its way through the pandemic.

"There's going to be an announcement in the next few days," Mr Poonawalla was quoted as saying.

For some businesses, the shift in the strategy is even more pronounced.

In November, the promoters of Indian budget carrier SpiceJet launched a healthcare company called SpiceHealth.

Although air travel has taken a severe hit from the pandemic, SpiceHealth has gone from strength to strength. Using a similar low-cost model adopted with its airline, SpiceHealth is trying to reach a large number of patients by offering budget healthcare services.

The company offers cut-price RT-PCR Covid-19 tests, conducted in mobile laboratories across five states, including Kerala, Delhi, and Maharashtra. SpiceHealth also has a genome sequencing laboratory at Delhi's international airport, aimed at trying to identify and contain the new mutant variants of Covid-19 that might be carried by travellers.

In the current crisis, it is focusing on addressing the country's oxygen shortages, which are being felt most acutely in Delhi.

“Amid the second wave of the coronavirus pandemic that has resulted in an acute shortage of oxygen in the country and a surge in Covid cases, SpiceHealth has been working actively with various state governments and hospitals across the country to address the issue,” says Avani Singh, the chief executive of SpiceHealth.

SpiceHealth has airlifted more than 2,000 oxygen concentrators in the last two weeks for emergency use and distribution across India and it is continuing these efforts, she explains, among other steps to help tackle the crisis.

“We have ramped up production of SpiceOxy ventilators and fingertip pulse oximeters to address the increased demand,” says Ms Singh.

Another company working to manage the crisis is Tata Group. It has imported 24 cryogenic containers needed to transport liquid oxygen and is also increasing its output of liquid oxygen from Tata Steel. The company has increased supplies of liquid medical oxygen to 800 tons a day.

“Given the oxygen crisis, we are putting in all our efforts to support India’s healthcare infrastructure,” Tata Group wrote in a post on Twitter.

Reliance Industries, controlled by India's richest person, Mukesh Ambani, repurposed plants at its Jamnagar refinery to produce medical grade liquid oxygen. The company, which was not a manufacturer of oxygen before the pandemic, is now producing 11 per cent of India’s total output, making it the country's largest manufacturer of oxygen.

As the second wave of infections rages on, the role of industries is proving key to India battling the current crisis.

“At the time of crisis, India and Indian industry have come together as a team,” says Mr Chandiramani.